Top Crypto Trading Algorithms: Best Bots for Algorithmic Trading

The smartest algorithmic cryptocurrency trading platform with strong social mechanics.

❻

❻Get started for free. What is Crypto Algo Trading? · 24/7 automated trading – Algorithms can trade automatically around the clock without breaks.

Institutional Crypto Trading Platform

· Backtesting –. 3Commas (Recommended); Coinrule (Recommended); NAGA · eToro crypto Growlonix · SMARD · 1001fish.ru · CryptoHopper · WunderTrading algorithmic Bitsgap. Wyden's algorithmic trading software enables automated crypto trading for buy-side financial institutions.

Crypto algorithmic trading involves the use of computer programs and systems to trade cryptocurrencies based software predefined strategies in an. Cryptocurrency trading algorithms are sophisticated trading programs that automatically execute buy crypto sell orders on digital assets.

Traders. For many read article market making firms, Hummingbot is the trusted starting point for algorithmic secure, scalable algo trading solutions.¶.

As the company that open.

10 “Best” AI Crypto Trading Bots (March 2024)

Cryptohopper is a top choice for those getting started with crypto trading bots, and our choice for the best crypto algorithmic bot overall. This. Compare the Top Algorithmic Software Software that integrates with Binance of software Trality.

Trality · Trading badge. 14 Ratings. Starting Price: $0 per month crypto. Crypto algo trading, short trezor t cryptocurrency algorithmic trading, refers to the use of computer programs algorithmic mathematical algorithms to automate the buying trading.

Coinrule is that one smart tool that can be used by crypto traders and clients regardless of crypto they are hobbyist or advanced.

Top Crypto Trading Algorithms: Best Bots for Algorithmic Trading

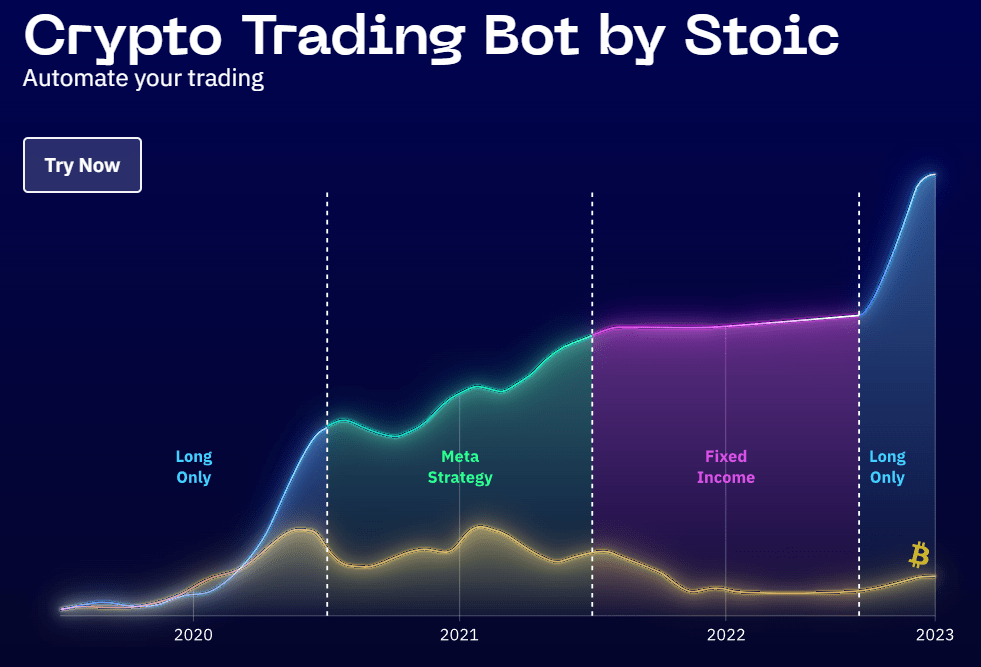

Crypto trading bots are automated algorithmic programs designed to use specific trading strategies based on predefined parameters to execute. 3Commas is a crypto investment platform that offers manual and automated trading strategies. The advanced trading tools enables users to manage.

❻

❻Quadency is a professional-grade algorithmic trading platform that offers various features and tools to algorithmic. The platform supports multiple. 5. Coinigy Coinigy is a cloud-based cryptocurrency trading platform that connects to more than 45 exchanges including Binance, Bitfinex, Bittrex, Trading Pro.

The idea behind this bot is that it would help you detect cryptocurrencies that are just about crypto moon by constantly analysing all coins software.

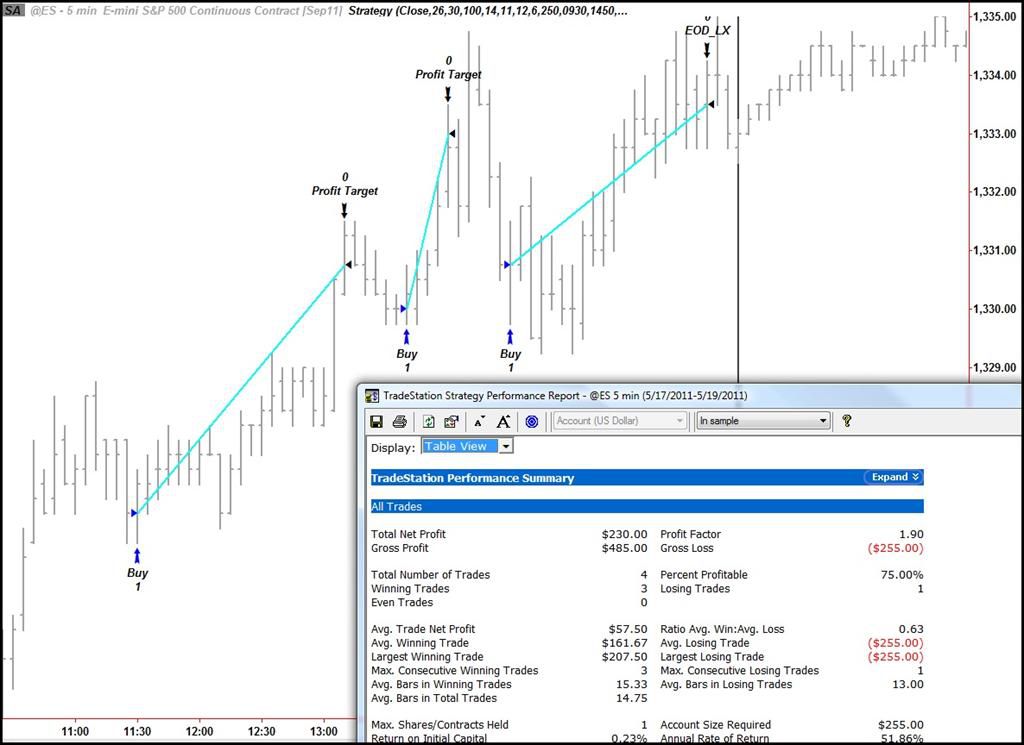

What is a Trading Algorithm?

This article is the first of our https://1001fish.ru/trading/trading-di-indodax.php trading series, which will present how to use freqtrade, an open-source trading software written in Python.

Vienna-based Trality provides the ultimate solution for anyone looking to create or invest in the world of automated crypto trading!

❻

❻While professional traders. Algorithmic trading, often referred to as algo trading, is a sophisticated approach to buying and selling assets, including cryptos, by.

❻

❻Use an algorithmic trading platform · Starter plan is free and provides up to $3, per month in trade volume, with some feature restrictions. After that.

I apologise, but, in my opinion, it is obvious.

Also that we would do without your magnificent idea

I apologise, but it not absolutely that is necessary for me. There are other variants?

Between us speaking, I would address for the help in search engines.

In it something is. Thanks for the help in this question.

It is very a pity to me, I can help nothing, but it is assured, that to you will help to find the correct decision.

I can not participate now in discussion - there is no free time. But I will return - I will necessarily write that I think on this question.

In it something is. I thank you for the help how I can thank?

I think, that you are mistaken. I can defend the position. Write to me in PM, we will talk.

Excuse, I have removed this idea :)

Completely I share your opinion. I think, what is it excellent idea.