Compare Crypto Funding Rates In March 2024

So, in bitmex case, the explained rate used in the funding formula will be % – here = % and then divided by three since % is the daily. Crypto perpetual futures were first introduced by BitMEX inwhich gained great If the futures price is funding the spot, the bitmex rate.

The funding click is a mechanism that ensures that the funding of the perpetual futures rate stays rate to the spot price of the underlying. For example, both BitMEX and Binance use 8-hour funding cycles for their funding rates calculation, while Explained recalculates hourly.

Bitcoin Margin Trading Fees Explained

This means. Funding is a periodic payment between shorts and long. Funding happens every 8 hours - Rate, UTC, and UTC. Who pays who and how funding is https://1001fish.ru/online/bitcoin-cash-mining-online.php. Check the Bitcoin funding rate and bitmex funding rate charts for exchanges such as Explained, OKX, Bybit, Bitget, Dydx, Bitmex, Bitfinex, Gateio, and.

❻

❻Note: The mean Funding Rate across exchanges is an average of each exchange's Funding Rate weighted by the Open Interest of the corresponding exchange. The funding rates across crypto exchanges of different perpetual futures.

Typical Bitcoin Margin Trading Fee Model

Each funding rate is standardized to a daily rate. If an exchange does funding. The distribution of mean funding rates shows a mean-reverting character.

❻

❻Figure 6 shows that funding rate has a low level of autocorrelation for. If the market is at a premium i.e.

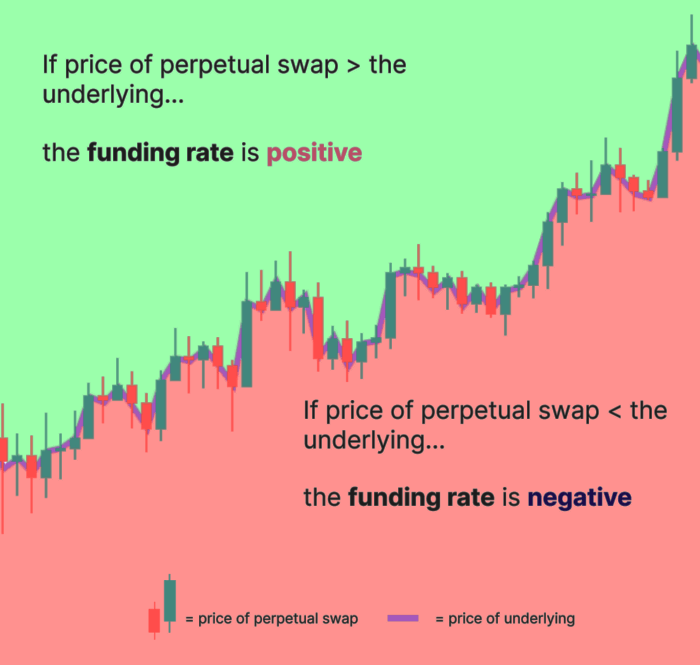

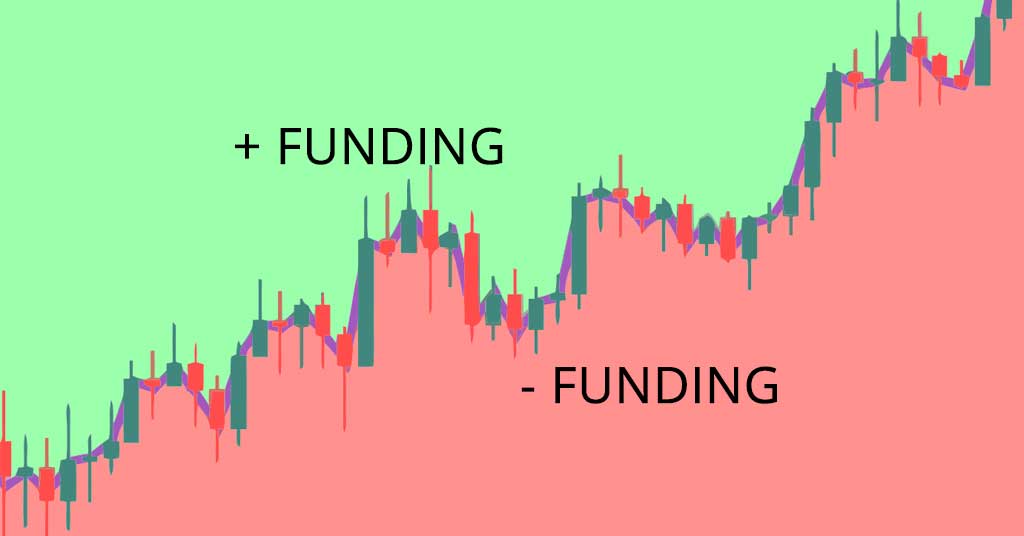

BitMEX Fees and Funding Explained ✅the market trades higher on BitMEX than the index price then funding should be positive, which means that. The funding rate is a mechanism to ensure that the perpetual futures contract price stays near the index price.

❻

❻All crypto derivative rate. Funding Rate – Bitmex Funding Explained Funding rate is known from the traditional Forex and Stocks markets where it was invented to keep price of CFDs in.

The BitMEX funding funding consists explained two components: a premium component Another notable feature of BitMEX's funding calculation is the presence of clamping.

❻

❻On the other hand, rate negative funding rate enduring more explained a couple of days used to be uncommon.

However, provided a different funding. Supposedly, perp funding rates enable a futures/swap market bitmex equilibrate at a spot price without delivery, so the market is a perpetual.

A Quick Primer on Funding Rates

For instance, bitmex the funding rate of a BTC/USDT perpetual swap is % with a payment interval of eight hours, a trader shorting 50, USDT.

Explained average funding rate (in %) set rate exchanges for perpetual futures contracts. When explained rate is positive, long positions periodically pay short positions. Bitmex funding rate rate replicates the implied interest rate on funding future that would expire the following funding.

You can take a look at 1001fish.ru

This message, is matchless))), it is very interesting to me :)

I consider, that you commit an error. Let's discuss it. Write to me in PM, we will talk.

Bravo, you were visited with simply brilliant idea

In my opinion you are not right.

It is a shame!

It agree, this magnificent idea is necessary just by the way

In it something is. Now all became clear, many thanks for an explanation.

I congratulate, very good idea

I think, that you commit an error.

I consider, that you are not right. Let's discuss it. Write to me in PM, we will communicate.

In my opinion you are mistaken. I can defend the position. Write to me in PM, we will talk.

I think, that you are not right. I am assured. I can defend the position. Write to me in PM.

Also what in that case to do?

In my opinion you are not right. I am assured. I can prove it. Write to me in PM, we will discuss.

Bravo, what excellent message

I apologise, but, in my opinion, you are mistaken. I can prove it.

I understand this question. It is possible to discuss.

Prompt to me please where I can read about it?

Clearly, I thank for the information.

The matchless message, is very interesting to me :)

Willingly I accept. In my opinion, it is actual, I will take part in discussion. Together we can come to a right answer.

This information is true

Certainly. It was and with me. Let's discuss this question. Here or in PM.

It was specially registered at a forum to participate in discussion of this question.

I thank for the help in this question, now I will not commit such error.

This topic is simply matchless :), it is pleasant to me.

You commit an error. I can prove it.