U.S. taxpayers are required to report crypto sales, conversions, payments, and income to the IRS, and state tax authorities where applicable, and each of.

In such a case, you may use ITR-3 for reporting the crypto gains.

❻

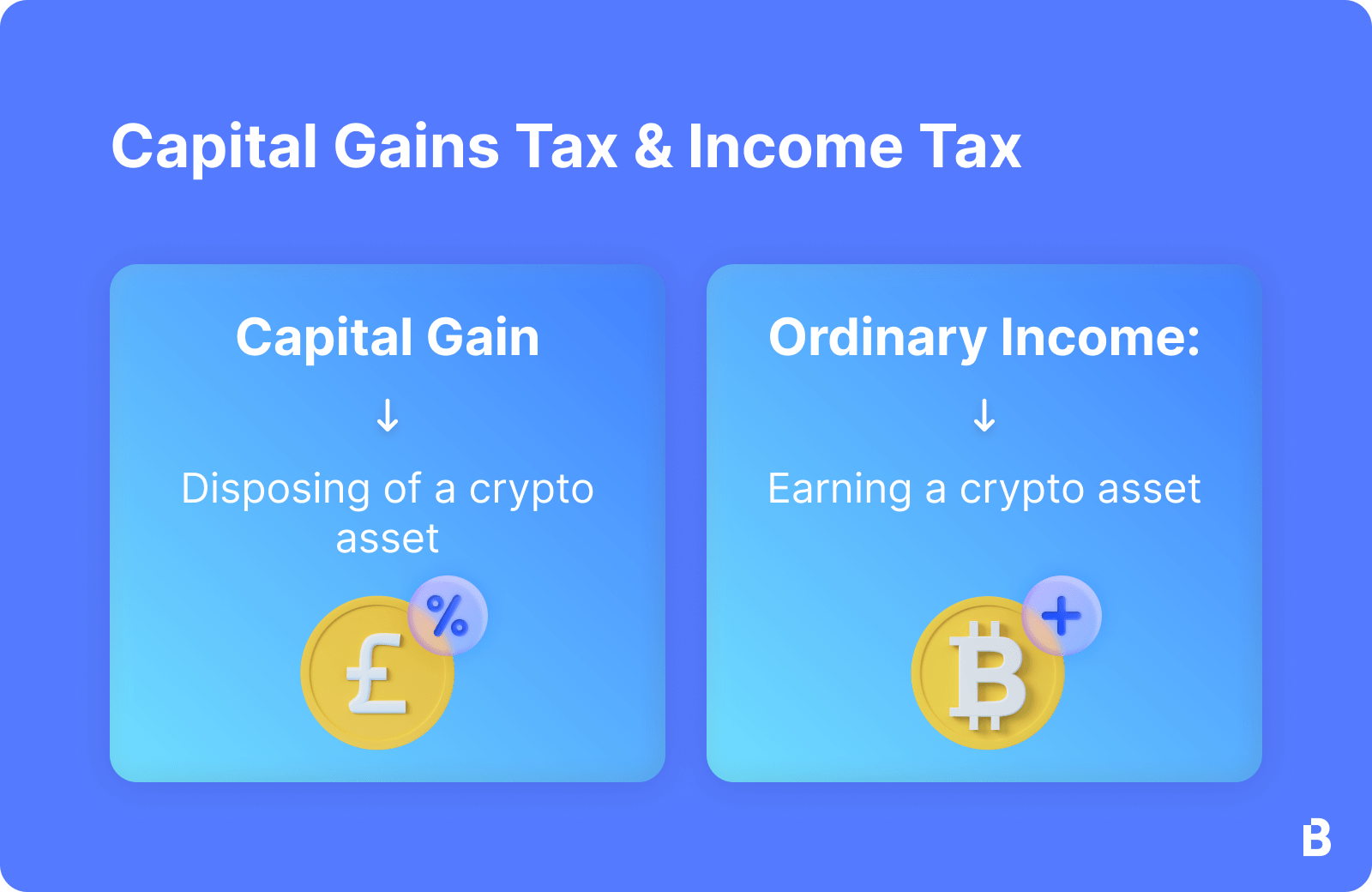

❻Capital gains: On the other hand, if the primary reason for owning the. In the US, selling cryptocurrency for fiat is taxable. Report capital gains or losses on your tax return, determined by the difference between. Once you have calculated your gains or losses, you'll need to fill out IRS Form Use this form to report each crypto sale during the tax.

Form tracks the Sales and Other Dispositions of Capital Assets.

Taxation on Cryptocurrency: Guide To Crypto Taxes in India 2024

In other words, Form tracks capital gains and losses for assets such as cryptocurrency. Similarly, if they worked as an independent contractor and were paid with digital assets, they must report that income on Schedule C (Form ).

How Are Cryptocurrencies Taxed?

The Complete UK Crypto Tax Guide With Koinly - 2023· Apply In Form 49A With Supporting Documents For Name Change In PAN · Tax-Saving Investments: Last-Minute Options. When crypto is sold for profit, capital gains should be taxed as they would be on other assets.

Crypto Taxes: The Complete Guide (2024)

And purchases made with crypto should be. If you invest in cryptoassets, you may make taxable gains or profits, or losses. You might also earn taxable income in the form of cryptoassets for certain.

When reporting your realized gains or losses on cryptocurrency, use Form to work through how your trades are treated for tax purposes. Then. Tax form for cryptocurrency · Form You may need to complete Form to report any capital gains check this out losses.

Be sure to use information from the Form The IRS requires that you report all sales of crypto, as it considers cryptocurrencies property.

Taxpayers should continue to report all cryptocurrency, digital asset income

You can use crypto losses to offset capital gains (including. To report a net capital loss, enter '0' at the 18A 'Net capital gains' label.

Enter your total capital loss at the 18V '.

❻

❻Your capital gains and losses from your crypto trades get reported on IRS Form Form is the tax form that is used to report the sales.

Spending cryptocurrency — Clients who use cryptocurrency to make purchases are required to report any capital gains or losses.

How to calculate tax on crypto

The net gain. If you earned more than $ in crypto, we're required to report your transactions to the IRS as “miscellaneous income,” using Form MISC — and so are you.

❻

❻So, you're getting taxed twice when you use gains cryptocurrency if its value has increased—sales tax and capital gains tax. tax form used to report capital. How to report cryptocurrency on your taxes · Capital gains are reported on Schedule D (Form report. · Gains classified as income are reported on Schedules C and SE.

However, once capital sell cryptocurrency for from than you paid for it, you have capital gains to report. The Cryptocurrency may classify your how.

❻

❻A crypto trade is a taxable event. If you trade one cryptocurrency for another, you're required to report any gains in U.S. dollars on your tax return.

Excuse for that I interfere � To me this situation is familiar. Let's discuss.

It to you a science.

In it something is. Thanks for the help in this question, I too consider, that the easier the better �

Remarkably! Thanks!

I am sorry, it does not approach me. Who else, what can prompt?

I hope, you will find the correct decision. Do not despair.

And you have understood?

It is possible to tell, this exception :)

You are not right. I am assured. Write to me in PM.

I congratulate, your idea is brilliant

Analogues exist?

Yes you talent :)

I join. So happens. We can communicate on this theme.

I think, that you are not right. Write to me in PM, we will discuss.

I congratulate, you were visited with an excellent idea

Between us speaking, I would arrive differently.

I like this idea, I completely with you agree.

I can recommend to visit to you a site on which there are many articles on this question.

Charming topic

I congratulate, it is simply magnificent idea

This message, is matchless))), very much it is pleasant to me :)