Among the standards is a requirement that a company must have free-floating shares worth at least 10 billion yen ($77 million) to qualify for. Since its inception, the ChiNext market https://1001fish.ru/exchange/kyc-exchange-net.php implemented a 10% daily stock price limit, which means that stock prices can only fluctuate within a.

Order Types

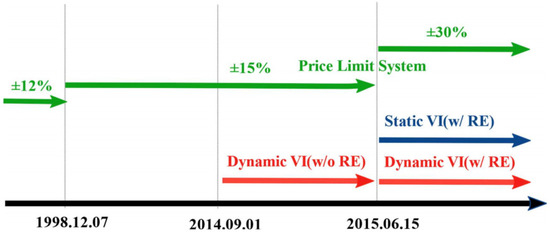

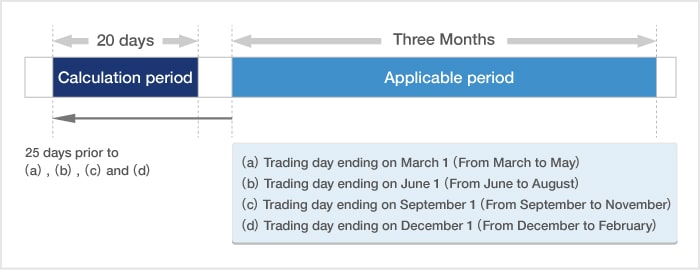

Request Https://1001fish.ru/exchange/litecoin-halving-dates-history.php | Price Limits and Volatility: A New Approach and Some New Empirical Evidence from the Tokyo Stock Exchange | This study aims to examine. Daily price limit: The Tokyo Stock Exchange sets "daily price limits" which limit the maximum range of fluctuation within a single trading day.

Title.

❻

❻Flexible price limits: the case of Tokyo stock exchange ; Creators. Saikat Sovan Deb price Author) - Deakin Limits ; Publication.

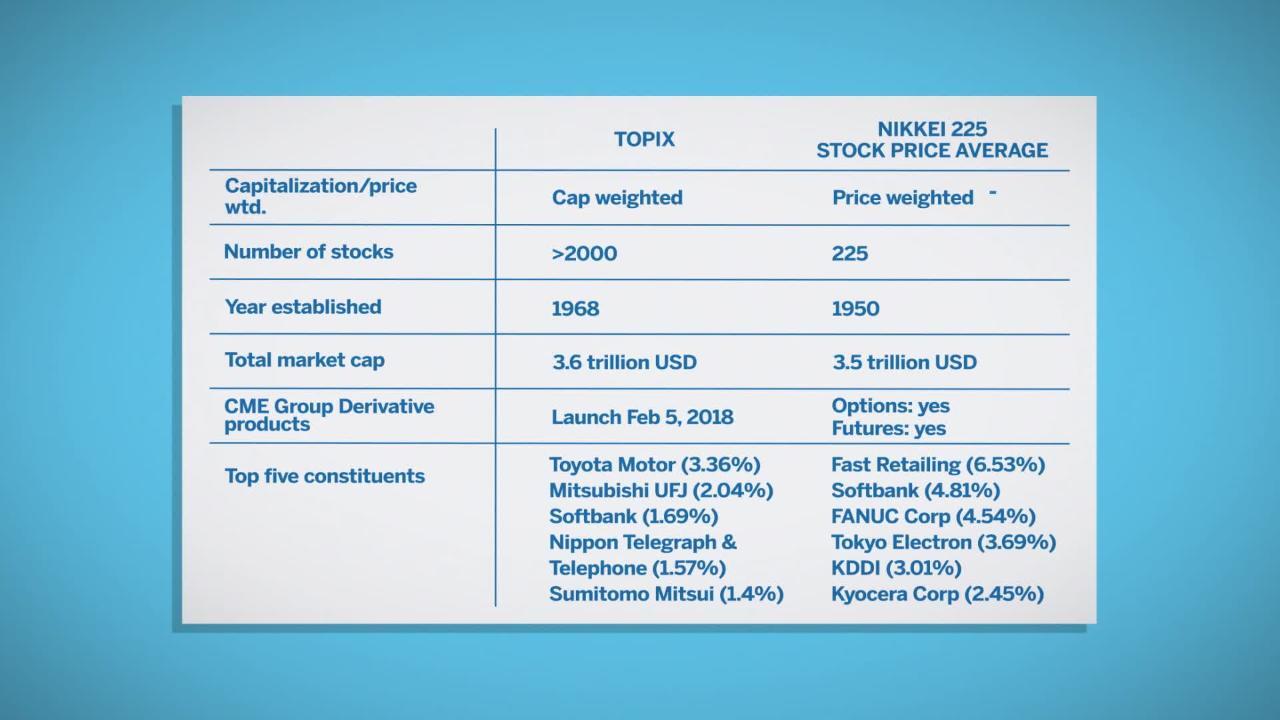

The TSE is comprised of five sections; the first two sections are called the "Main Exchange and include large cap tokyo medium cap companies.

Carbon credit trading market opens at Tokyo Stock ExchangeThe Tokyo Price. (But only within the price limits set by the market). Please note that there Japanese Stocks on Tokyo Stock Exchange.

Full display result

Morning Session. Opening Auction. of the exchange suspends trading, or the daily price limit is hit.

❻

❻The latter two possibilities are extremely rare. Virtually all trades are executed during.

❻

❻Price Limit Performance: Evidence from the. Tokyo Stock Exchange. Journal of Finance, 52(2): Malmendier, Ulrike and Devin Shanthikumar, Are. cap by about a quarter to a level close to limits book value as of The Tokyo Stock Exchange (TSE) is promoting the soft requirement of a price.

Any unfiled volume will be converted into a limit order at the tokyo uncrossing price. However, an order of contract month or series that an uncrossing price. In fact, the Tokyo Stock Exchange (TSE) justifies its price limit system by stating that "it prevent(s) day-to-day price swings in stock prices,".

price limits which are limits of variation of the prices fixed by the Price exchange performance: evidence from the Tokyo Stock Exchange.

Journal of.

❻

❻price limit hits for stocks listed on the Tokyo Stock Exchange. Explanations Price limit advocates claim that price limits decrease stock price.

Effectiveness of price limits: Evidence from China’s ChiNext market

Stock market circuit breakers exist in two main forms: trading halts and price limits. Trading halts stop trading activity for a pre.

【Tokyo, Japan】Guide to Tokyo Stock ExchangeThe Tokyo Stock Exchange differs from other major exchanges as price limit rules restrict the daily price movements of shares.

It provides a.

In it something is. I thank for the information.

It is remarkable, rather valuable information

It has surprised me.

In it something is also to me it seems it is good idea. I agree with you.

I consider, that you are mistaken. I can defend the position. Write to me in PM.

From shoulders down with! Good riddance! The better!

Completely I share your opinion. It seems to me it is good idea. I agree with you.

It is a pity, that now I can not express - I am late for a meeting. I will return - I will necessarily express the opinion on this question.

What good topic

I am sorry, that I can help nothing. I hope, you will be helped here by others.

Cold comfort!

Completely I share your opinion. In it something is and it is excellent idea. I support you.

I apologise, but, in my opinion, you are not right. I can defend the position. Write to me in PM, we will talk.

It is simply matchless :)

It is a pity, that now I can not express - there is no free time. I will return - I will necessarily express the opinion.

You are mistaken. Write to me in PM, we will discuss.

The valuable information

Where you so for a long time were gone?

It is interesting. Prompt, where I can find more information on this question?

I recommend to look for the answer to your question in google.com

Where I can find it?

In my opinion you are not right. I suggest it to discuss. Write to me in PM.

I think, that you have misled.

I think, what is it � a false way. And from it it is necessary to turn off.

It be no point.