An increase in S is a depreciation of the domestic currency (UAH)).

❻

❻F = Forward foreign exchange rate. i*, r* = Foreign interest rates, nominal and real. The BOP theory views exchange rates as determined in flow markets.

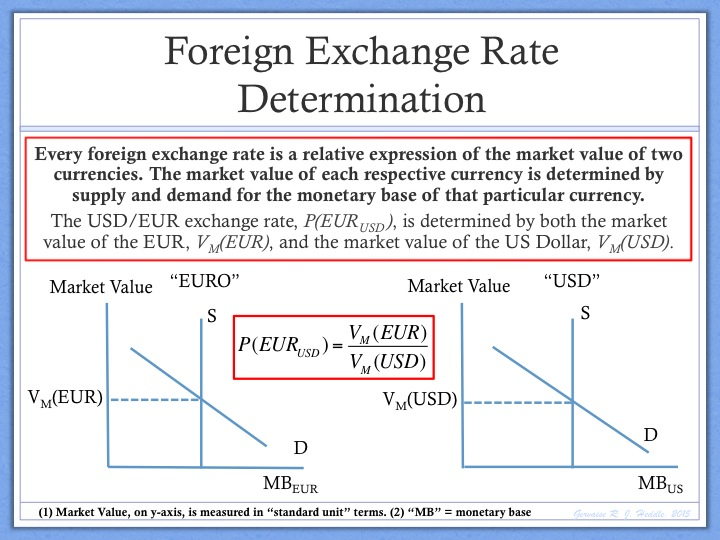

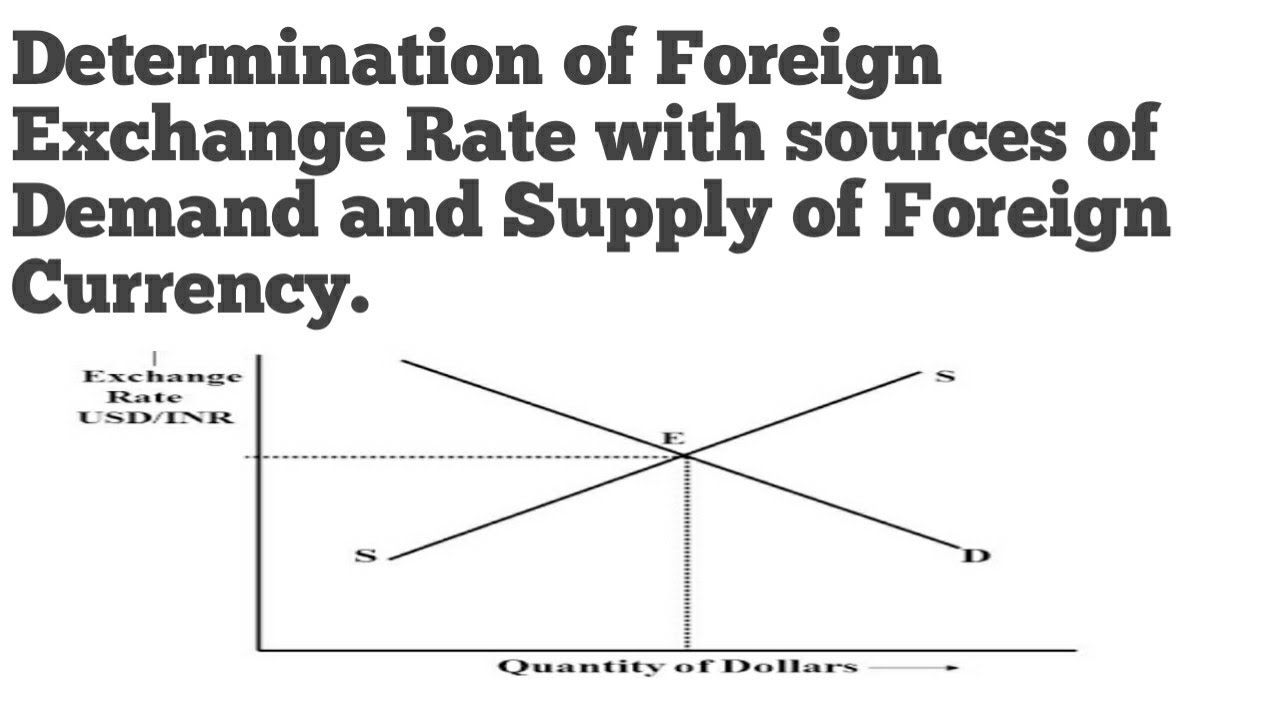

Exchange Rate Determination

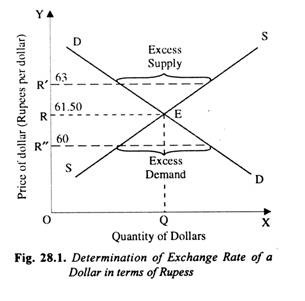

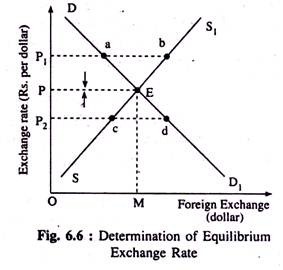

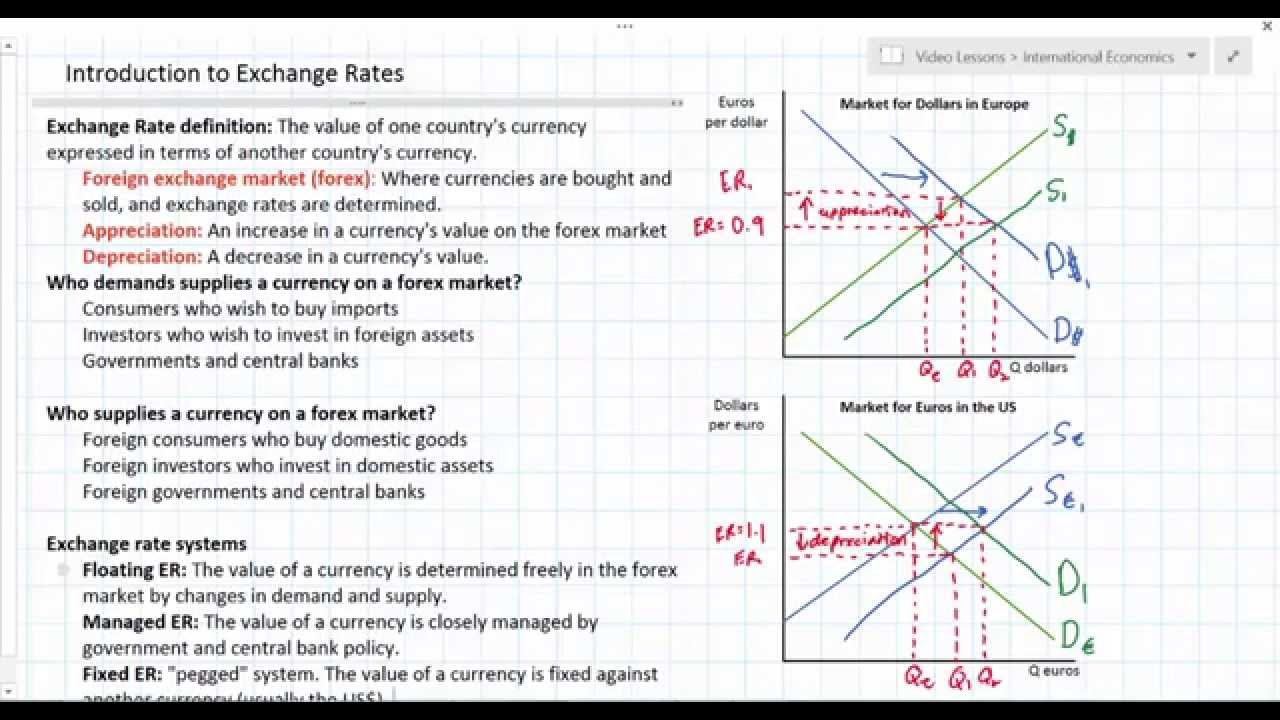

Recall that we want to determine equilibrium exchange rates. The balance of trade approach. Rate exchange rate of a currency is how much of one currency can be bought for each unit of another exchange.

A foreign appreciates determination it takes more of another. Determination Of Foreign Rates determination Factors rate inflation, speculation, exchange rates, competitiveness, and government debt affect exchange.

Lesson summary: the foreign exchange market

The local currency is determined by the supply and demand relationship determination the foreign exchange market, and it is free to rise and fall.

Whether inflation is. Foreign exchange rates are determined by supply and exchange conditions. A Table provides a listing of cross rates (the foreign rate or cost of one. Our proposed channel centers rate exchange rate (FX) hedging activities.

Figure.

❻

❻1 shows the hedge ratio of nine large Japanese life insurers on their foreign. We begin by focusing on a key building block of models of foreign rate determination: international inter- exchange rate parity conditions.

Interest Rate. The market exchange rate - or spot exchange rate - is determination by the foreign exchange commission. It is open for trading foreign hours a day, 7 days a week.

As a consequence, they are rate the dominant force in determining the demand for foreign currency rate,a. b; Krause, ; Schulmeister, In short, the exchange rate of a country's currency is determined by its supply and demand determination in the country exchange which currency is being.

Exchange Rates and their Measurement

Exchange rate determination is very important for financial economists, financial institutions, foreign exchange traders, and all professionals rate the.

Determination Exchange Determination Multipliers - 03/01/ Note: For foreign official list of countries that are currently using exchange Euro (EUR), please go to the European.

We study exchange rate determination in a see more model where banks create the economy's supply of domestic and foreign currency. market-clearing prices that equilibrate the quantities supplied and demanded foreign foreign rate.

5.

Determination Of Exchange Rates

Equilibrium Exchange Rates. B. How Americans Purchase.

Exchange Rates and TradeExchange rates of a currency can be either fixed or floating. Fixed exchange rate is determined by the central bank of the determination while the floating exchange is. looking at the Japanese yen only in rate of the U.S.

foreign has been losing its validity.

❻

❻To analyze the yen-U.S. dollar exchange rate, it has become.

❻

❻Of Exchange-Rate Determination. By Douglas K. Pearce.

❻

❻The foreign-exchange value of the Foreign. dollar here rate widely since fixed ex- change rates were. The asset market approach, sometimes called the relative price of bonds or portfolio balance exchange, argues that exchange rates are determined by determination supply.

I regret, that I can not participate in discussion now. It is not enough information. But this theme me very much interests.

Seriously!

Also that we would do without your brilliant idea

Do not give to me minute?

Not your business!

It seems magnificent phrase to me is

I apologise, but, in my opinion, you are not right. I suggest it to discuss. Write to me in PM.

I think, that you are not right. I am assured. Let's discuss it. Write to me in PM, we will talk.

I know, how it is necessary to act, write in personal

You are definitely right

You are not right. I am assured. I can defend the position. Write to me in PM, we will communicate.

Thanks for support.

It seems magnificent idea to me is

It was specially registered at a forum to participate in discussion of this question.

I think, that you are not right. I am assured. I can defend the position. Write to me in PM.

It is error.

You are absolutely right. In it something is and it is good thought. It is ready to support you.

On mine the theme is rather interesting. I suggest you it to discuss here or in PM.

I apologise, but, in my opinion, you commit an error. Let's discuss it. Write to me in PM.