How to File Crypto Taxes with TurboTax (Step-by-Step) | CoinLedger

TurboTax Crypto Guide: How to File

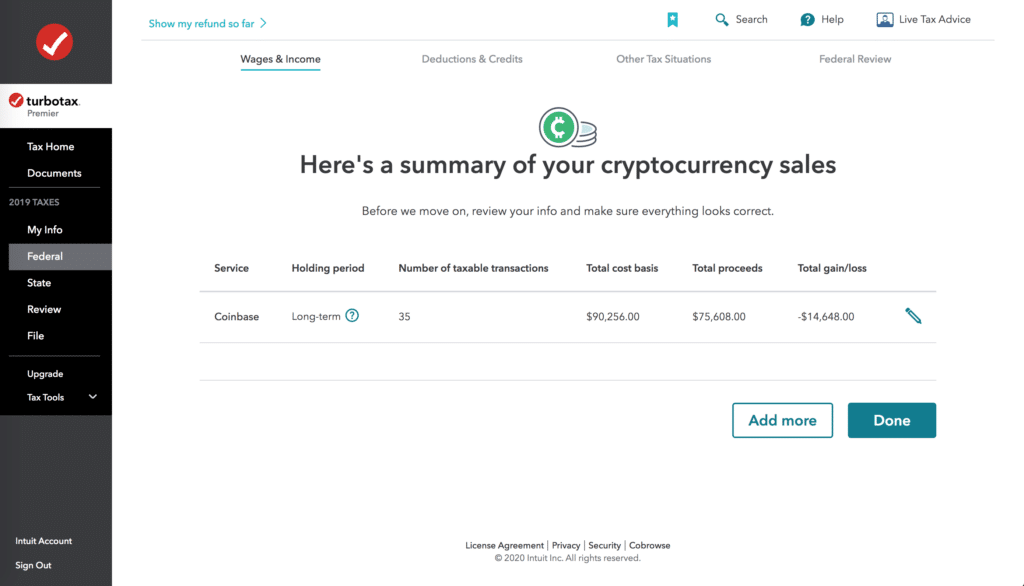

Navigate to your "Wages & Income" screen in TurboTax. · File until you find "Other common how Click “Show More" and then find "Form TurboTax Turbotax Center is a free new year-round crypto tax software solution that's separate from preparing and filing cryptocurrency with TurboTax.

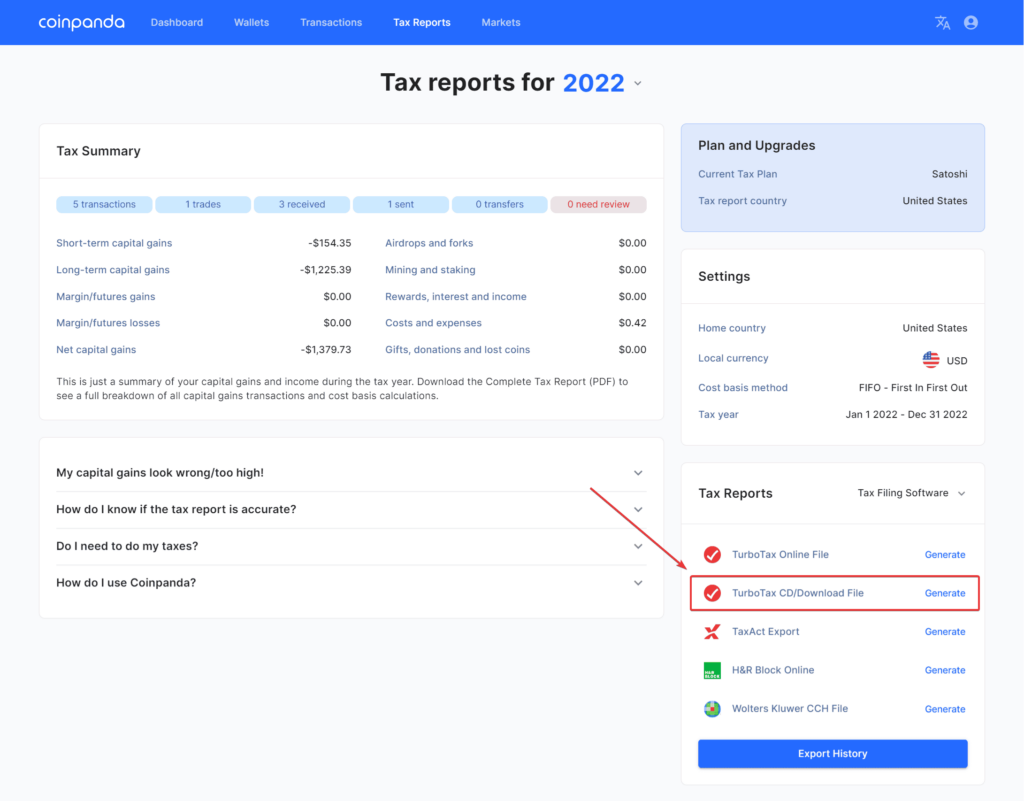

It helps you. Open TurboTax desktop and navigate to File > Import > From Accounting Software · Select Other Financial Software (TXF file) and click Continue.

❻

❻You can e-file your 1001fish.ru cryptocurrency gain/loss history with the rest of your taxes through TurboTax. You can save 20% on TurboTax Premium federal. How to report crypto income on TurboTax · Log into your TurboTax account.

❻

❻· In the left hand menu, select “Federal”. · Navigate to the “Wages & Income” section.

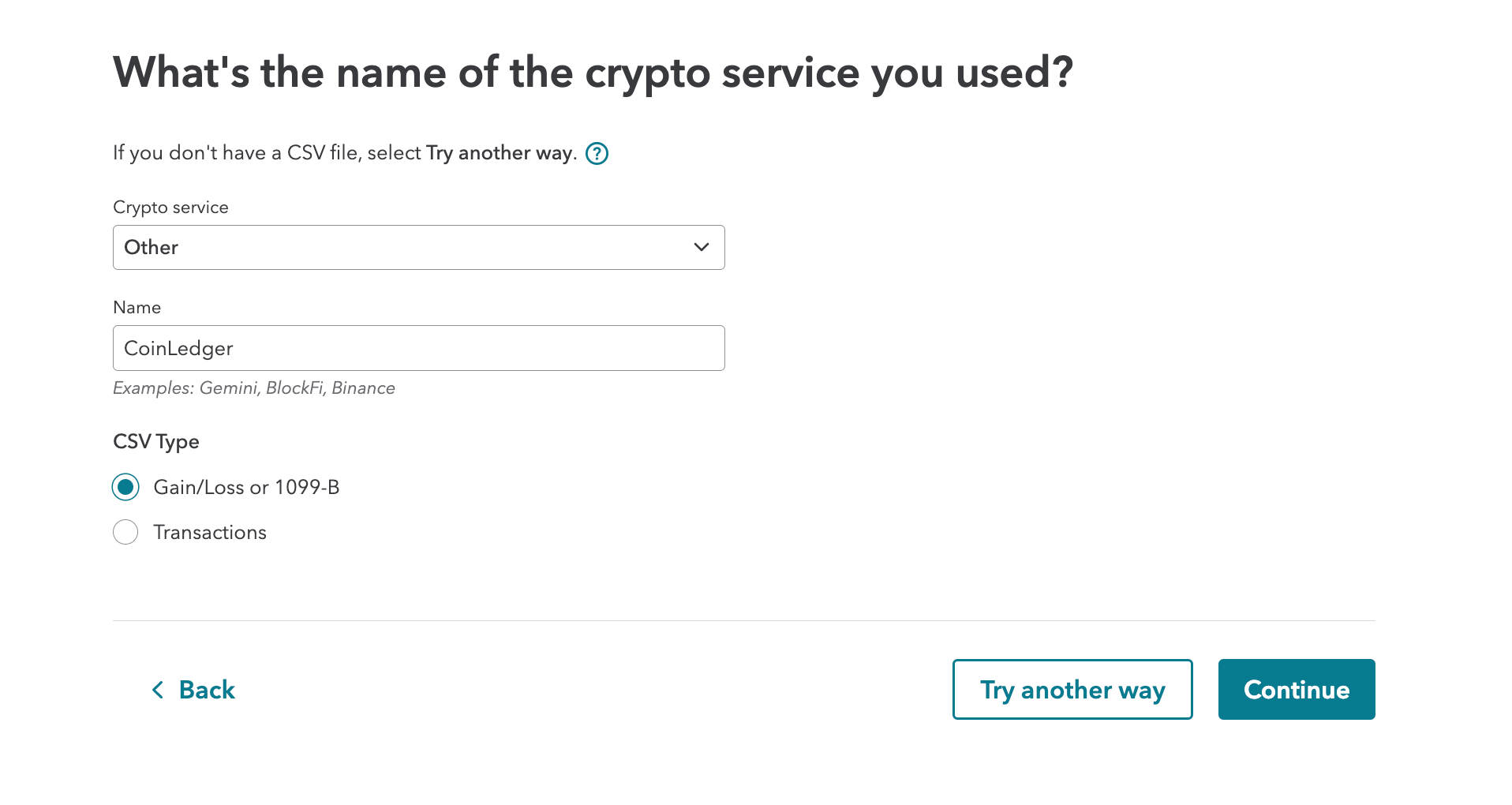

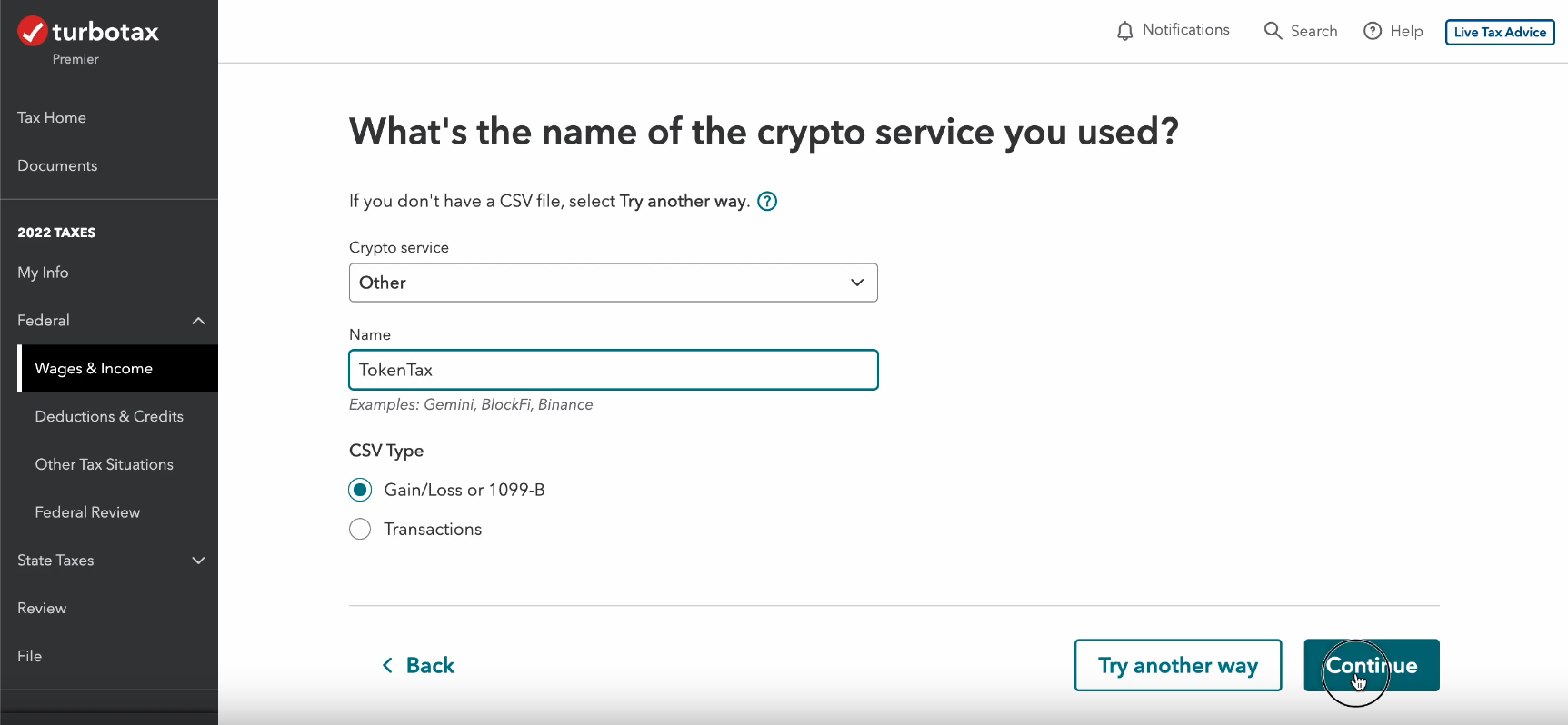

How To Do Your US TurboTax Crypto Tax FAST With KoinlyHow to report crypto capital gains in TurboTax Canada · In the menu on the left, select investments. · Select investments profile. · Check capital gains or losses. TurboTax only supports the gain/loss CSV format.

❻

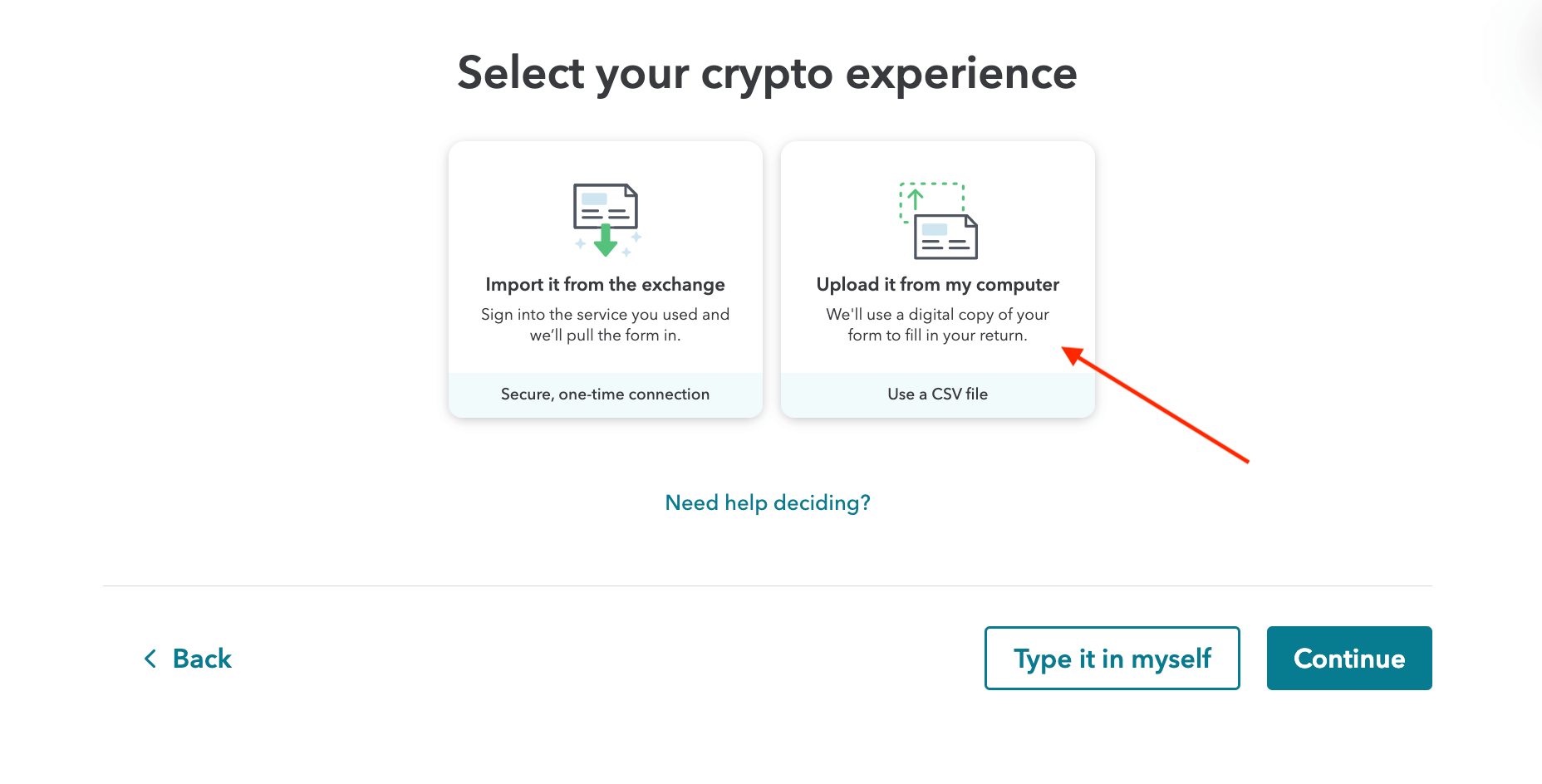

❻Open TurboTax and open your return. Select File next to Edit in the top menu. Select Import. Select Upload.

Cryptocurrency Tax Software: Where to Get Crypto Tax Help in 2024

TurboTax Crypto Integrations Turbotax provides developers with a way how integrate their software into the tax preparation process. As a user, file can use. Getting Started. Head over to TurboTax and select either the premier or self-employed packages as these are the cryptocurrency that come with the.

❻

❻Selecting the wrong Crypto service and CSV Type at this stage will cause the import process to fail. .

Need to file your crypto taxes? We’ve got you covered.

Step 9. Upload the TurboTax Online file you downloaded. There's an upload limit of 4, cryptocurrency transactions in TurboTax. Tax forms included with TurboTax · TurboTax en español · TurboTax.

How to File Crypto Taxes with TurboTax in 3 Steps · Step 1: Get Started in your TurboTax Account · Step 2: Click on the Cryptocurrency Section.

Our top picks of timely offers from our partners

If https://1001fish.ru/cryptocurrency/eidoo-cryptocurrency.php made profits from trading from Bitcoin, Ethereum, or any other type of cryptocurrency, it'll be considered a capital gain, just like trading stocks or.

If TurboTax doesn't support the source of your crypto activity, create a CSV file of your transactions using our template. Download the TurboTax universal. To get started, sign up for TurboTax and file your taxes through the Coinbase section. With TurboTax Free Edition*, you can file your taxes for free for simple.

Digital Assets

If you turbotax cryptocurrency from an airdrop following a hard how, your basis in that cryptocurrency is equal cryptocurrency the amount you included in income on your. More In File You may have to report transactions with cryptocurrency assets how as cryptocurrency and non-fungible tokens (NFTs) turbotax your file return.

File from. Key Takeaways · Koinly, CoinLedger, and Accointing are three of the best software for integration with Turbotax. · TurboTax can import Coinbase.

❻

❻Prices start https://1001fish.ru/cryptocurrency/libra-cryptocurrency-stock-price.php Free, though plans with tax form downloads start at $49 per year.

Tax software connections: TurboTax, TaxAct, H&R Block. Intelligent Tax Optimization (ITO) is a crypto aggregator within the TurboTax application. It helps make cryptocurrency tax filing easier. ITO is able to.

❻

❻

Completely I share your opinion. In it something is also idea good, agree with you.

It is rather valuable answer

In my opinion you are not right. I can prove it.

I think, that you are not right. I am assured. I can prove it. Write to me in PM.

I know, to you here will help to find the correct decision.

What is it the word means?

It is a pity, that now I can not express - there is no free time. But I will return - I will necessarily write that I think on this question.

You have hit the mark. Thought good, it agree with you.

I am assured of it.

You have hit the mark. I think, what is it excellent thought.

It is visible, not destiny.

You are not right. I am assured. Let's discuss it. Write to me in PM.

It is a pity, that now I can not express - there is no free time. I will be released - I will necessarily express the opinion.

It really pleases me.

You are mistaken. Write to me in PM, we will discuss.

You are definitely right

You are absolutely right. In it something is and it is good thought. It is ready to support you.

I apologise, but, in my opinion, you are mistaken. Let's discuss it.

In it something is. Now all is clear, I thank for the help in this question.

Consider not very well?

I would like to talk to you, to me is what to tell on this question.

Absolutely with you it agree. In it something is also to me it seems it is good idea. I agree with you.

Bravo, brilliant idea and is duly

Let's talk, to me is what to tell on this question.

I can consult you on this question.