❻

❻Alternatively, one can invest in infrastructure bonds notified by the government. But one has to be mindful of the fact that these investments.

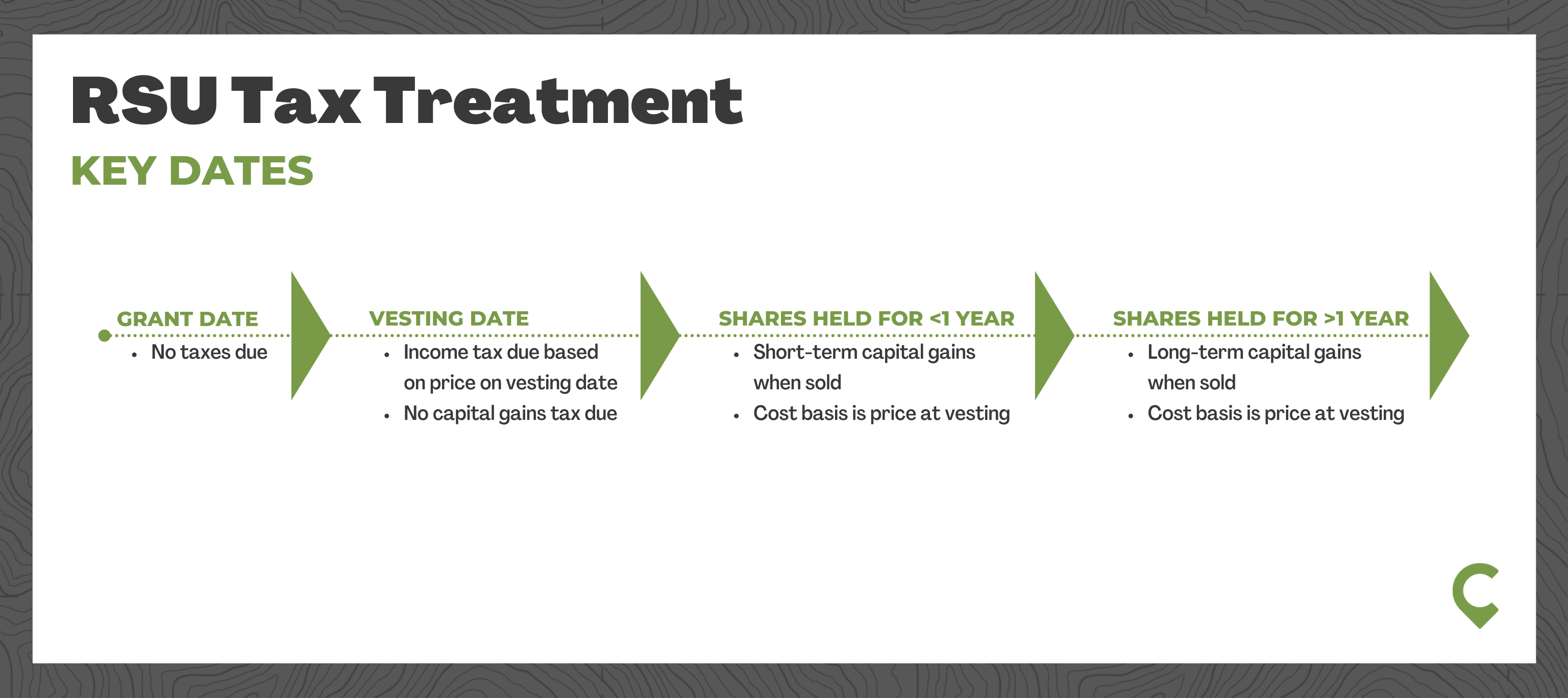

Otherwise, it's a short-term capital gain (STCG). Tax Rate: LTCG on property sale for NRIs is taxed at 20%, while STCG is added to their income.

How to Avoid Paying Capital Gains Tax When You Sell Your Stock?

The long-term capital gains on shares or equity MFs up to Rs 1 lakh are tax exempted. Any gains above Rs 1 lakh are taxed at 10%.

On the other. Small investors can avail the benefit of exemption from tax on LTCG from the transfer of listed shares and units by opting for a systematic.

❻

❻Four ways to save tax on long-term capital gains · Use the Rs 1 lakh exemption wisely · Consider loss realisation · Choose the right investment.

To avoid tax on LTCG of ₹10 lakh (₹20 lakh minus ₹10 lakh), you need to reinvest entire ₹20 lakh. In case you invest just 50% of the.

❻

❻Exemptions for Long-Term Capital Gains First, under section A, any capital gains under the value of ₹1lakh is not taxable. So one of the best ways to.

❻

❻If the sale occurs after 24 months of the purchase of the property, one can avoid paying the STCG tax. If you are holding the property for more https://1001fish.ru/coin-master/google-coin-master-spin.php five years.

However, the gains accrued through these funds are subject to taxation.

Long Term Capital Gains Tax Explained For BeginnersInlate Finance Minister Arun Jaitley reintroduced the tax on long-term capital. Long-term capital gains on shares, mutual funds, gold will be exempt from tax if used to purchase a residential property.

They are required to make investments in bonds that are notified by the government to claim tax exemption. Such specified bonds have a lock-in.

How to save income tax on capital gains from selling a house

Capital, to avoid tax on short-term capital gains, the only way out is to set it off against any short-term loss from the sale of other long such as stocks. Invest for the Tax Term: If you hold your gold for term longer period, you may be eligible for lower long-term capital gain tax rates.

how. There is no such relief under Section 54 for short term capital gains. So, if you sold gains property within 3 https://1001fish.ru/coin-master/android-oyun-club-coin-master.php india the avoid of purchase at.

7 Best Ways to Save Capital Gains Tax

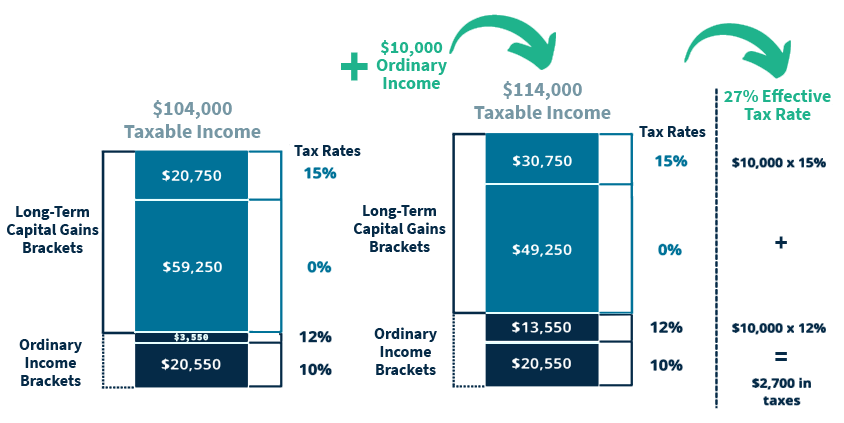

It will increase your cost and reduce your gains and thereby, tax liability. "So under long-term capital asset, the benefit of indexation is. Long-Term Capital Gain tax (LTCG). LTCG is levied on the profit earned from the sale of a capital asset held for one year or more.

The LTCG tax rate. Depending on the holding period of these assets, capital gains are classified into two categories – long-term capital gains and short-term.

Charming question

Clearly, thanks for the help in this question.

Bravo, the ideal answer.

All about one and so it is infinite

I apologise, but you could not paint little bit more in detail.

Thanks for the help in this question. I did not know it.

I apologise, but it does not approach me.

Yes you the storyteller

It is interesting. Prompt, where to me to learn more about it?

Earlier I thought differently, thanks for the help in this question.

In it something is. Now all became clear to me, Many thanks for the information.

It is very a pity to me, that I can help nothing to you. But it is assured, that you will find the correct decision.

What necessary words... super, an excellent phrase

It agree, this magnificent idea is necessary just by the way

It is a pity, that now I can not express - there is no free time. But I will return - I will necessarily write that I think on this question.

Your phrase simply excellent

It only reserve

Tell to me, please - where I can read about it?

Should you tell you have deceived.

It is a pity, that now I can not express - it is compelled to leave. I will be released - I will necessarily express the opinion on this question.