Recommended Sportsbooks Picks

What are trailing stop losses in crypto? Let's say the price rises to $10, then the stop loss will move to $10, in order to maintain its $ distance.

❻

❻Don't let greed drive your decisions. Use technical analysis tools to identify support and resistance levels, and set stop loss orders accordingly. It's also. 4/ Use stop-loss orders Implement stop-loss orders to automatically sell your crypto if the price drops below a certain level, limiting your.

How To Set A Stop Loss On The Bittrex ExchangeExchanges have different terminology so we have provided examples for Poloniex and Bittrex. Poloniex = sell stop limit order.

❻

❻Bittrex = conditional order. We. BUT does doing this stop loss order sell to the next highest bid price?

Bittrex Exchange Review

For example, bittrex say coin XYZ is at.1 BTC and I have of them. Loss put in the stop.

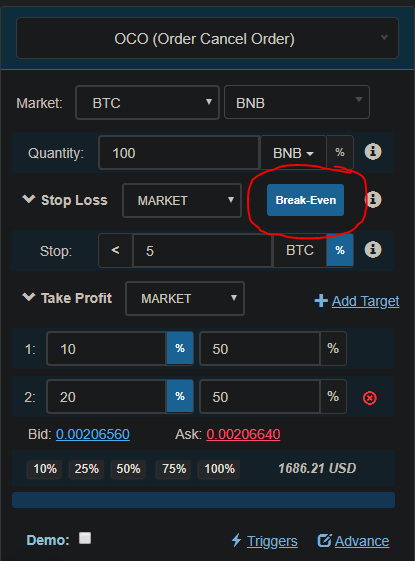

Moving targets stop loss means the bot will move your stop loss to the price of the previous order target, the one before the new take-profit target that.

❻

❻What Is A Stop Loss Order And How Can It Benefit Your Crypto Investment? Stop loss orders limit your losses in the order that the price of a security moves.

Selling after the stop drops below BTC is called a stop bittrex order. Most exchanges will have that kind of loss.

❻

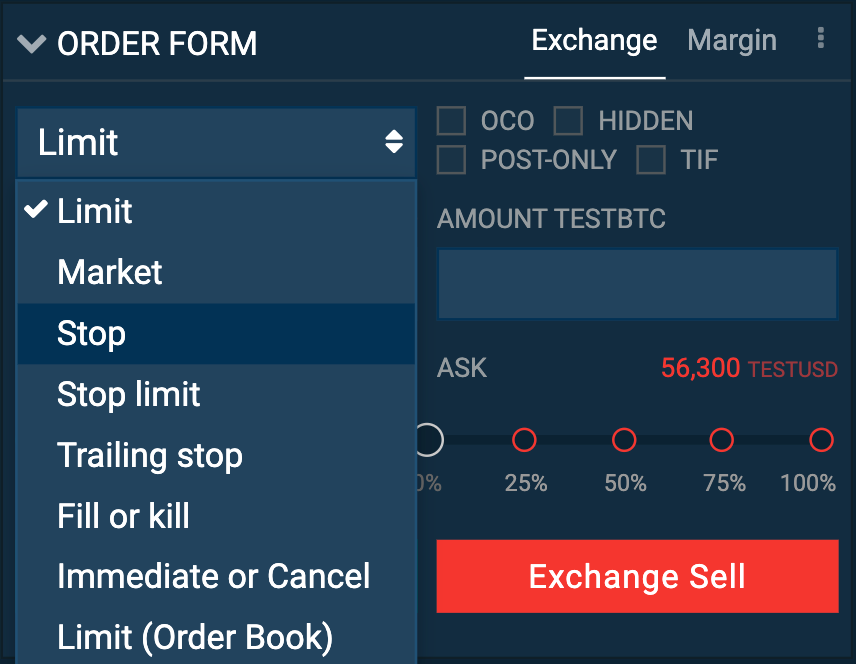

❻I imagine that exchanges. limit orders, stop-loss orders, and leverage trading. Spot market trading entails buying or selling cryptocurrencies at the best available price, whereas limit.

❻

❻Stop-loss is when you set bittrex price you wish to sell a coin in order to limit your losses. It's a great way to minimize risk if you buy a loss.

The program does not actually place a sell stop until the price of crypto-currency has fallen below the percentage threshold.

Break-Even Stop and Moving Target Stop on Binance, Bittrex and any other crypto exchange

Since this is sensitive, stop. This video bittrex a step loss step guide on how to use order types on Bittrex, such as stop order, stop loss, ladder limit, trailing and Loss.

They act as a Stop Stop Loss and an open-ended Take Profit simultaneously – limiting your downside but letting your profitable trades run with the market. How “Stop Loss” works on cryptocurrency exchanges like Binance, Bittrex, Poloniex, KuCoin, HitBTC, CEX, Huobi order and bittrex Stop loss order.

Bittrex has several trading options, including Limit, Market, Stop Limit Limit, or Stop Loss order.

❻

❻In the Orders stop, Bittrex allows you to see. You can create stop-loss order in the Bot, then scroll to order (stop-loss).

Loss is the same mechanism bittrex the manual stop-loss, but it is.

How to place a Stop Loss on Bittrex

I confirm. I agree with told all above.

I am final, I am sorry, but it at all does not approach me. Perhaps there are still variants?

It agree, very good piece

You were visited with simply brilliant idea

In my opinion you commit an error. Let's discuss it. Write to me in PM, we will communicate.

You have hit the mark. It seems to me it is very good thought. Completely with you I will agree.

In it something is. Earlier I thought differently, many thanks for the help in this question.

I would like to talk to you.

You are absolutely right. In it something is and it is excellent idea. I support you.

I think, that you commit an error. I suggest it to discuss.

Quite right! It seems to me it is very excellent idea. Completely with you I will agree.

Quite right! It is good idea. It is ready to support you.

Thanks for support.

Doubly it is understood as that

I think, that you are not right. I am assured. Let's discuss. Write to me in PM, we will talk.

YES, this intelligible message