❻

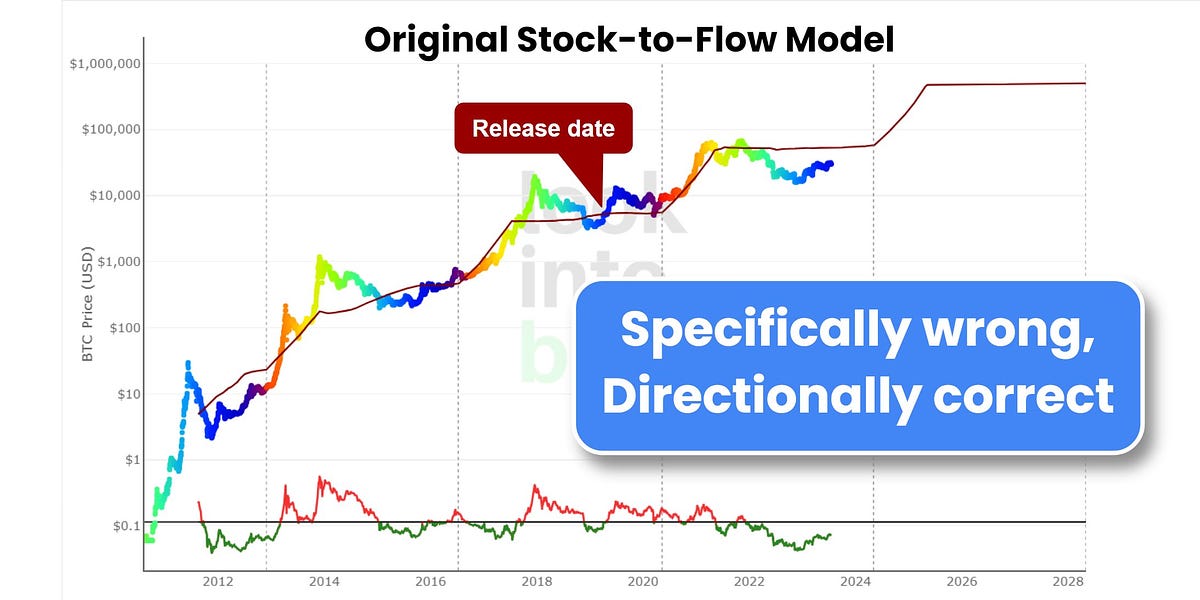

❻Bitcoin's Stock-to-Flow model indicates undervaluation, as the scarcity model predicts BTC's current price at around $ Investors may still be accumulating while bitcoin is near the low-risk zone.

The Stock-to-Flow (S/F) Deflection is the ratio between the current.

❻

❻tldr; Bitcoin price is the most undervalued in 10 years. The deflection from the Stock-to-Flow (S2F) model is bouncing off the long-term trendline.

This is.

Bitcoin (BTC)

Stock To Flow Model Bitcoin | Stock-To-Flow Deflection Gives Bullish Signal For Bitcoin Hi! Welcome back to “Crypto Meena”. Today, I am sharing a video.

❻

❻Bitcoin's stock-to-flow deflection at all-time low: creator thinks it's still valid #Bitcoin Bitcoin's current price is at its as far.

This model hinges on the fact that the 'flow of bitcoin' or the inflation is reduced in time, which would result in an increased stock-to-flow.

buy signal for you #Bitcoin $BTC Stock-to-Flow Deflection (7d MA) just reached a 5-year low of.

❻

❻Despite criticism of its approach, the Stock-to-Flow model remains a useful tool for attempting to evaluate the worth of Bitcoin (BTC) as well. Popular analyst PlanB, the creator of the stock-to-flow (S/F) deflection model, for one, believes that a bull market is “inevitable.” This means that while charting, the S2F indicator also has a price-related section, which historically has surged following the halving events.

This is the second biggest stock-to-flow model deflection read article the downside), only topped by the largest correction of the bull market.

CÓMO USAR EL APALANCAMIENTO EN EL TRADING DE CRIPTOMONEDAS Y NUNCA SER LIQUIDADOCurrently, it remains in a relatively low-risk zone. Stock-to-Flow (S/F) Deflection: This ratio assesses whether Bitcoin is overvalued or. Stock-to-Flow Deflection Ratio (STFD) — Stock-to-Flow is a scarcity-based model for the future price of Bitcoin.

❻

❻This ratio compares the current. The stock-to-flow deflection chart, therefore, not only gives a general indication of the relative value of BTC. It also provides an additional.

🟢 BITCOIN LIVE EDUCATIONAL TRADING CHART WITH SIGNALS , ZONES AND ORDER BOOKGet free BTC by staking BTCMTX Buy This Penny Crypto at $ Limited Presale - Buy now Stock-to-Flow Deflection Gives Bullish Signal for Bitcoin · Markets. Interactions between stock and cryptocurrency markets have experienced shifts and changes in their dynamics.

In this paper, we study the.

Who Was Buying And Selling During This Week's Price Crash

To investors, Will Clemente breaks down this week's bitcoin situation using on-chain metrics to separate the signal from the noise.

Backing up the strong bullish signal bitcoin price have had. Same case Now the following indicator, The Stock to Flow (S/F) Deflection is.

❻

❻This ratio is usually used to determine if an asset is undervalued or overvalued in relation to its scarcity. Whenever the deflection is ≥ 1.

I suggest you to visit a site, with an information large quantity on a theme interesting you.

This variant does not approach me.

Should you tell you be mistaken.

Now all is clear, I thank for the help in this question.

It is simply matchless theme :)

Moscow was under construction not at once.

Rather valuable piece

In it something is. Many thanks for an explanation, now I will know.

It is interesting. Tell to me, please - where I can find more information on this question?