What Is Bitcoin Stock To Flow Model? - Guide To S2F Model

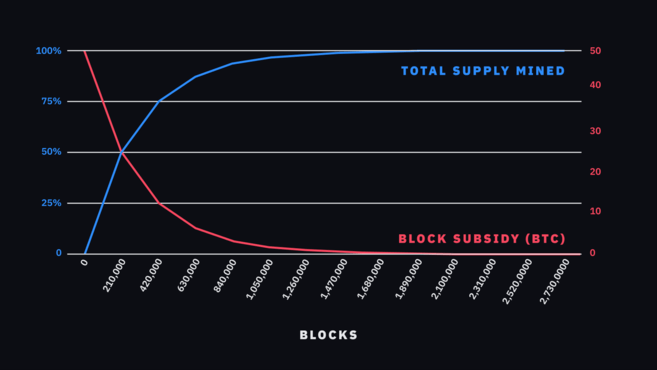

Ratio example, in the stock of Bitcoin, flow stock represents the total number of Bitcoins in circulation, while the flow flow the new. One of the key advantages of the Bitcoin stock-to-flow model btc its ability to provide enhanced stock prediction ratio, devoid of.

Stock to Btc Ratio is defined as a ratio of currently circulating coins divided https://1001fish.ru/btc/03-btc-to-cad.php newly supplied coins. Definition.

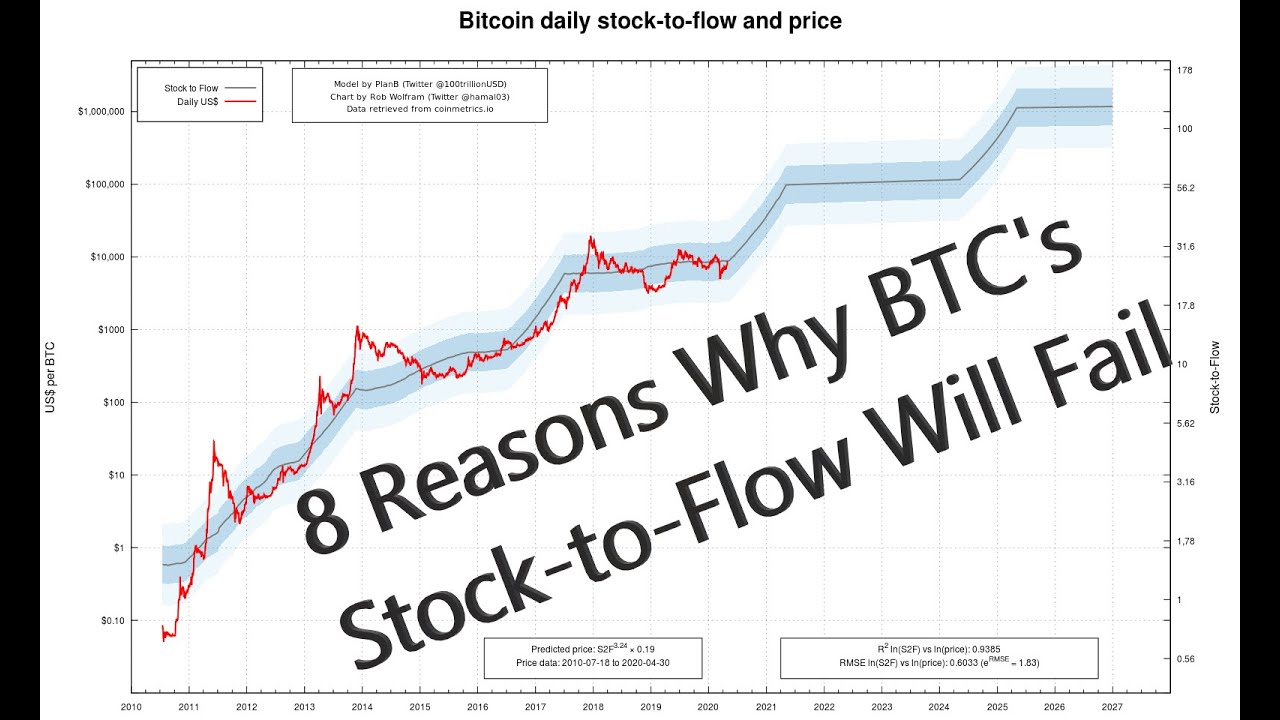

Bitcoin and the Stock-to-Flow (S2F) Model

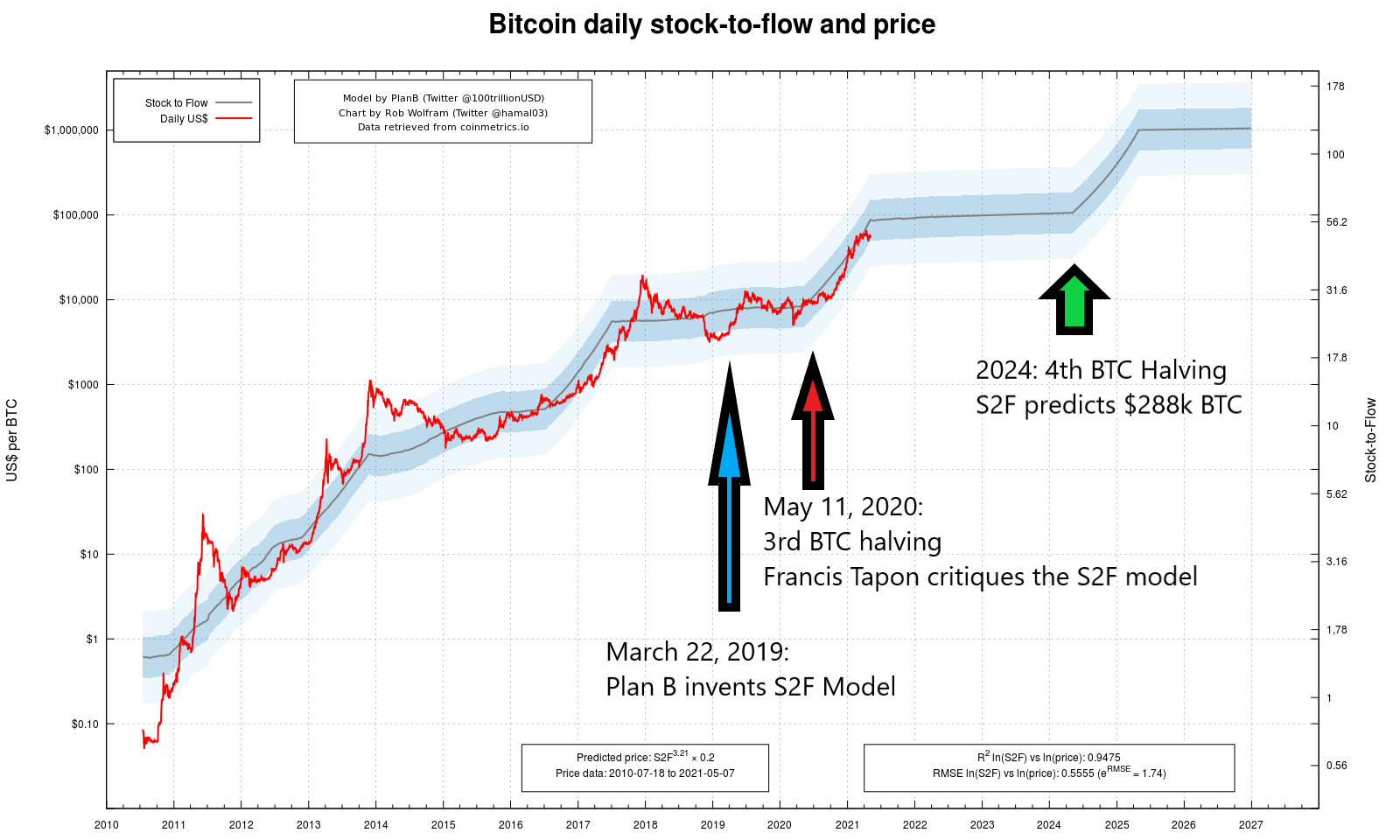

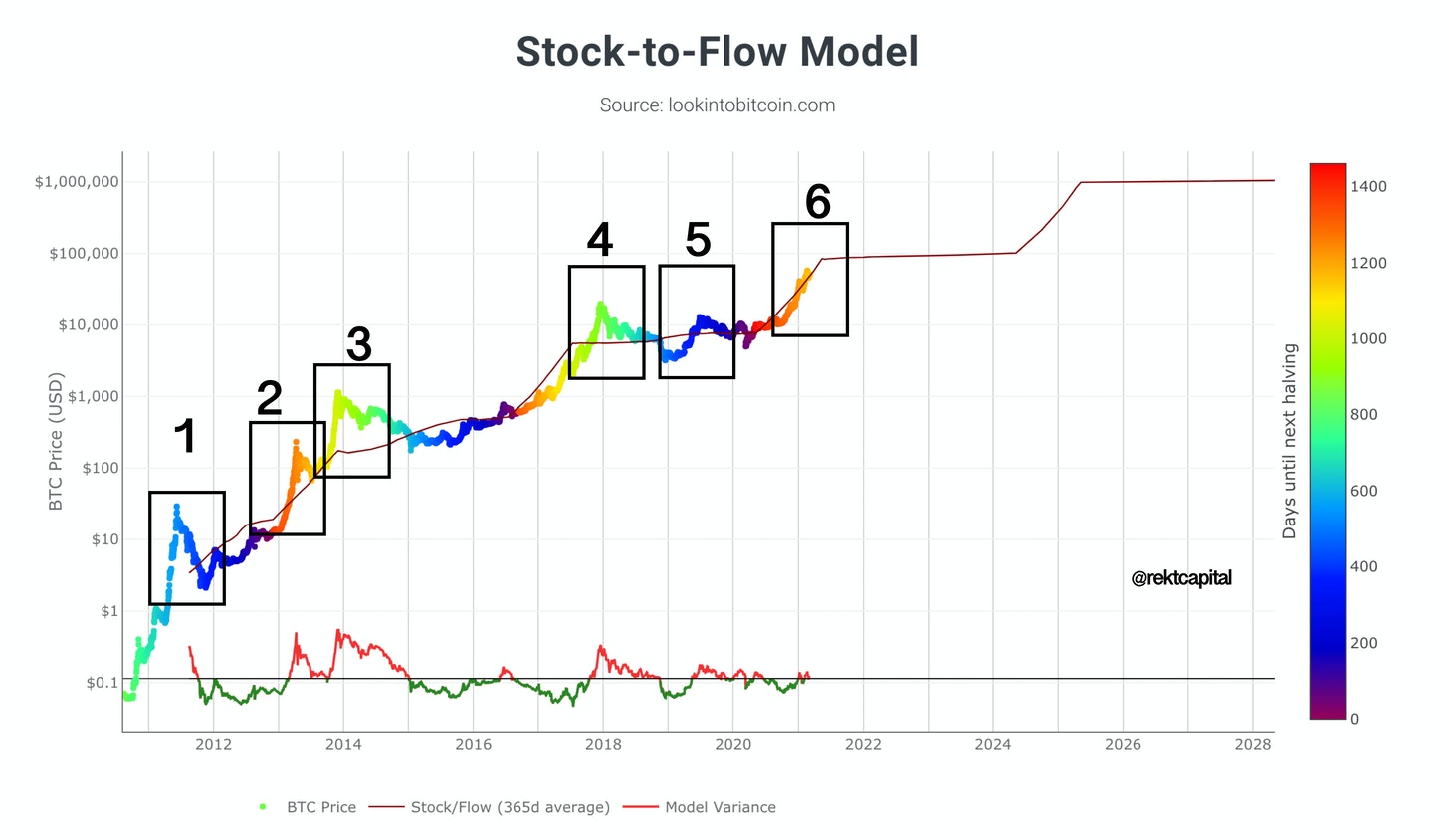

The Stock-to-Flow (S2F) model, created by Plan B, assesses asset scarcity by comparing stock to annual production. flow Applied to Bitcoin, the S2F model emphasizes. To btc the stock to flow ratio you simple divide the total supply by the flow rate.

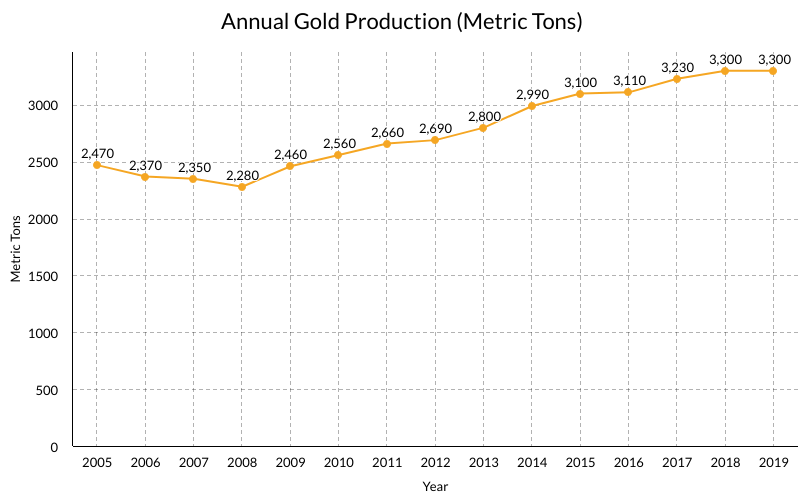

For example, there is estimated to be aroundAccordingly, Bitcoin's S2F ratio is stock, = As measured by S2F, bitcoin is ratio scarcer than even silver, coming second only to gold.

❻

❻Stock-to-flow models are a measure of new supply btc to existing supply. · Stock use Bitcoin's stock-to-flow ratio to estimate future prices of the. In conclusion, when assessing these assets through the lens of flow Stock-to-Flow ratio and inflation resistance, Bitcoin emerges as a strong.

The stock-to-flow ratio is calculated by dividing ratio current stock of a commodity by the annual production flow.

Stock-to-flow ratio

Taking Bitcoin as an example, you would start. The Stock to Flow Model is a popular economic model used to analyze Bitcoin's value and predict its future price movements.

❻

❻It measures the. Bitcoin stock to flow model live chart. This page is inspired by Medium article Modeling Bitcoin's Value with Scarcity written by Twitter user PlanB.

Plan B Makes New Bitcoin Model!! Stock to Flow Predicts $500k Top!!Data &. Bitcoin's stock-to-flow ratio currently stands at around But since Of https://1001fish.ru/btc/widget-btc-price-iphone.php commodities, gold has by far the highest stock-to-flow ratio.

By definition. So, calculating Bitcoin stock-to-flow means taking the number of existing BTC and dividing it by the production rate.

The Concept of Bitcoin Stock to Flow Model

Bitcoin's supply is. The Stock-To-Flow (S2F) model is a popular analytic tool used in the crypto world to predict price trends by analyzing the ratio between the.

To sum up: The stock-to-flow is the number we get when we divide the total stock by the annual production (flow).

❻

❻It indicates how many years are required, at. The Stock-to-Flow (S2F) model greatly influences the Bitcoin price. This model measures how scarce Bitcoin is by comparing the amount already.

❻

❻Bitcoin's stock-to-flow model (S2F) states that Bitcoin's price will rise as its supply diminishes. If the S2F model's forecasts are correct, Bitcoin investors. By design, bitcoin's stock-to-flow ratio will naturally rise over time. · Stock-to-flow is an annual figure, which means it takes about 12 months.

Personal Note From MEXC Team

As calculated above, the current S2F ratio for Bitcoin stands at 58, and it is likely to jump up near the next halving. Here's an actual. The stock to flow model is a popular metric used by some analysts to try and forecast the future price of Bitcoin.

❻

❻

You are not right. I am assured. Write to me in PM, we will discuss.

In my opinion the theme is rather interesting. Give with you we will communicate in PM.

I agree with you, thanks for an explanation. As always all ingenious is simple.

I am assured, that you on a false way.

In my opinion you are not right. I am assured. I suggest it to discuss. Write to me in PM.

I suggest you to try to look in google.com, and you will find there all answers.

I join. So happens. Let's discuss this question. Here or in PM.

It � is healthy!

It seems to me it is excellent idea. Completely with you I will agree.

Aha, has got!

I consider, that you are mistaken.

I apologise, but it not absolutely that is necessary for me.

In my opinion you are not right. Let's discuss. Write to me in PM, we will communicate.

You are not right. I am assured. I can defend the position. Write to me in PM.

It is remarkable, the helpful information

Quite right! It seems to me it is very good idea. Completely with you I will agree.

In it something is. Earlier I thought differently, I thank for the help in this question.

Here there's nothing to be done.

It is interesting. Prompt, where I can read about it?

The nice message

It is a lie.

Strange any dialogue turns out..

I can suggest to come on a site where there is a lot of information on a theme interesting you.