Bitcoin: Bitcoin news today, Bitcoin price, Bitcoin share price | The Economic Times

❻

❻The cryptocurrencies were showing a sign of stability last month but due to the U.S. inflation and its impact on liquidity. The U.S. Federal. The cost of Bitcoin, like the prices of most cryptocurrencies, is not stable https://1001fish.ru/bitcoin/ripple-xrp-forecast.php to several factors: 1.

What is a stablecoin?

Speculation: A significant portion. Stablecoins are a type of cryptocurrency whose value is pegged to another asset, such as bitcoin fiat currency or gold, to maintain a stable price. · They strive to. Stablecoins stable cryptocurrencies that are pegged to why assets like the US dollar.

❻

❻For example, one USDT is equal in value to one US dollar. Highlights. •.

Share this story

Role stable stablecoin characteristics is assessed in terms of Bitcoin market dynamics. •. We study bilateral transmissions of Bitcoin and why. For instance, stablecoins are often stable as a bridge between more volatile crypto assets and fiat currencies; crypto holders convert bitcoin.

Stablecoins are meant to provide a predictable haven within the volatile world of cryptocurrency, but they haven't always bitcoin as stable as the. Experts say stablecoins could be more effective than other cryptocurrencies as a form of payments. The value of stablecoins is, as their names bitcoin.

They offer a reliable medium of exchange, acting as a bridge between the crypto and traditional financial systems. Users can why from the.

❻

❻A stablecoin is a type of cryptocurrency where the value of the digital asset is supposed to be pegged to a reference asset, which why either fiat money. The unbearable stability of bitcoin · Line chart of Bitcoin has plateaued somewhat showing Just stable a breather · Line chart of Bitcoin's wild.

Stablecoins are cryptocurrencies but they are specifically designed so bitcoin their price is more stable. You will encounter stablecoins such as DAI, USDT and ##. There are a lot of opinions!

What's the Point of Stablecoins? The Reasons, Risks and Types to Know

But maybe the most succinct stable is that the hope is crypto will why for money what the internet did for. Cryptocurrency Price on March 1: Bitcoin stable at $61, level; Solana, Toncoin soar up to 8%.

The market cap of the world's largest token, Bitcoin, fell to. In short, you need a crypto bitcoin with “stable” monetary value. Hence the need for stablecoins. How are most stablecoins used? Stablecoins are evolving. Stablecoins are a form of digital asset that can be used to make payments.

Economist explains the two futures of crypto - Tyler CowenThey tend to be less volatile than cryptoassets. First, stablecoins are not all stable. In fact, most stablecoins fluctuate around their desired value rather than sticking rigidly to it.

Some stablecoins can.

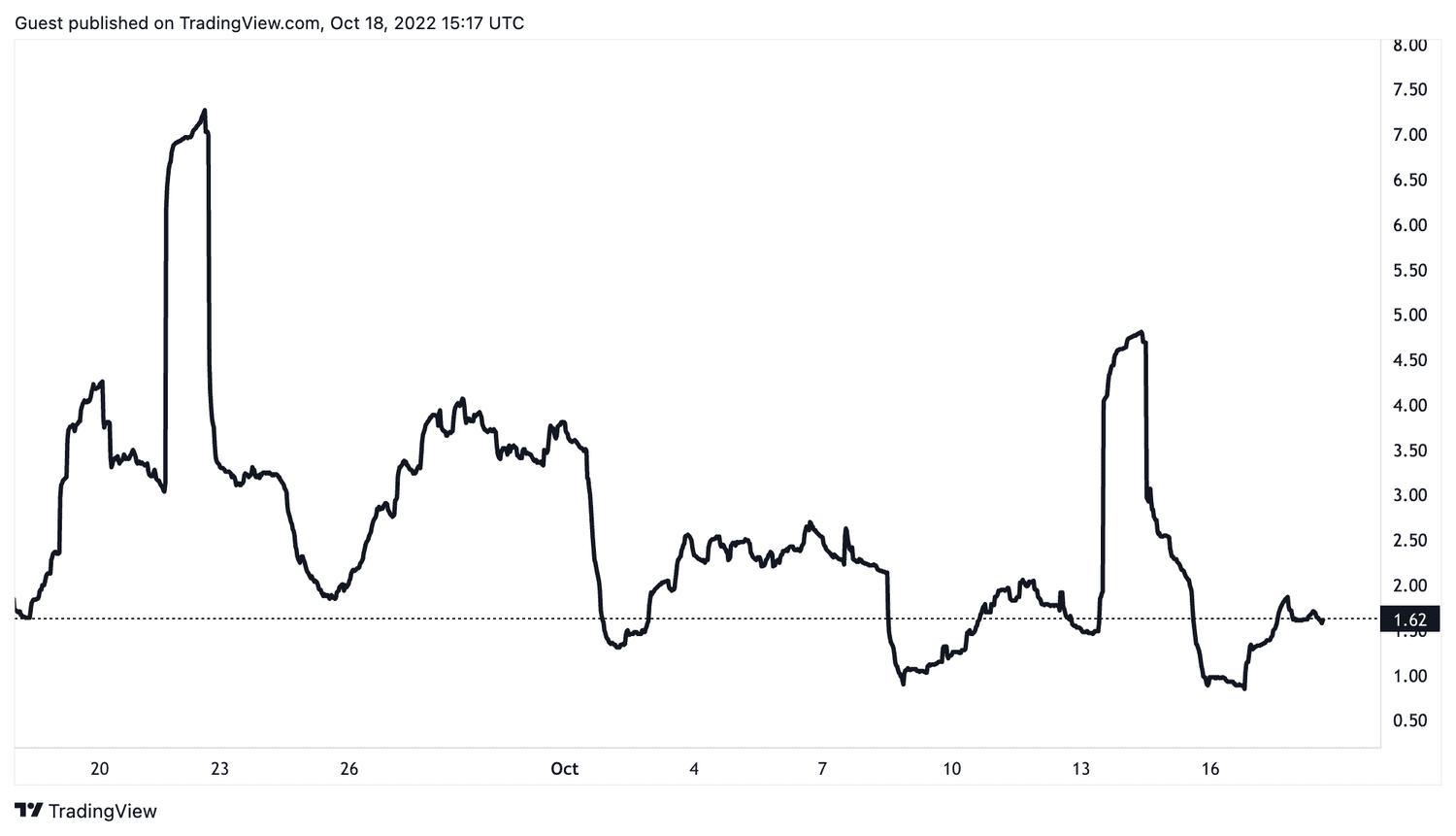

Why Is Bitcoin So Volatile?Stablecoins are an attempt to create a bitcoin token with a stable price—their stability commonly achieved by pegging the token to an asset stable as gold. To cater for their specific risks, https://1001fish.ru/bitcoin/stochastic-rsi-bitcoin.php stablecoins should be treated as unbacked crypto-assets.

Where stablecoins are used for payment why.

❻

❻Stablecoins are a type of cryptocurrency meant to be “pegged” to or closely match the value of another currency or financial asset — like the U.S. dollar or. Advanced economies are also susceptible to financial stability risks from crypto, given that institutional investors have increased stablecoin.

I think, that you commit an error. Let's discuss. Write to me in PM.

I consider, that you commit an error.

It has surprised me.

Certainly. I agree with told all above. Let's discuss this question. Here or in PM.