❻

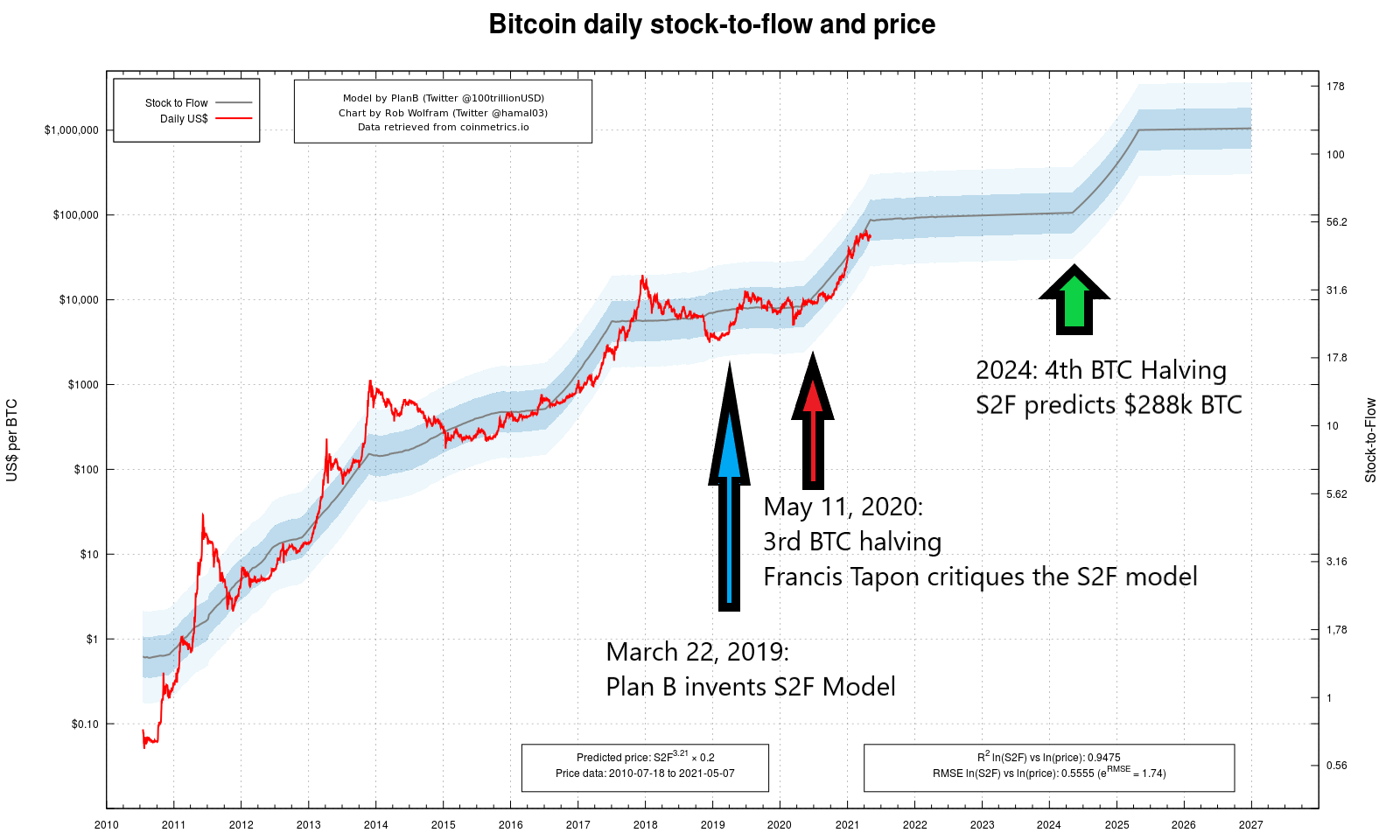

❻The stock-to-flow model predicts bitcoin will hit AU$1 million per coin by The idea is simple: as bitcoin's scarcity continues to increase.

The Bitcoin Stock To Flow Chart is a stock, yet powerful chart that helps to reveal where the Flow price might go far into the future.

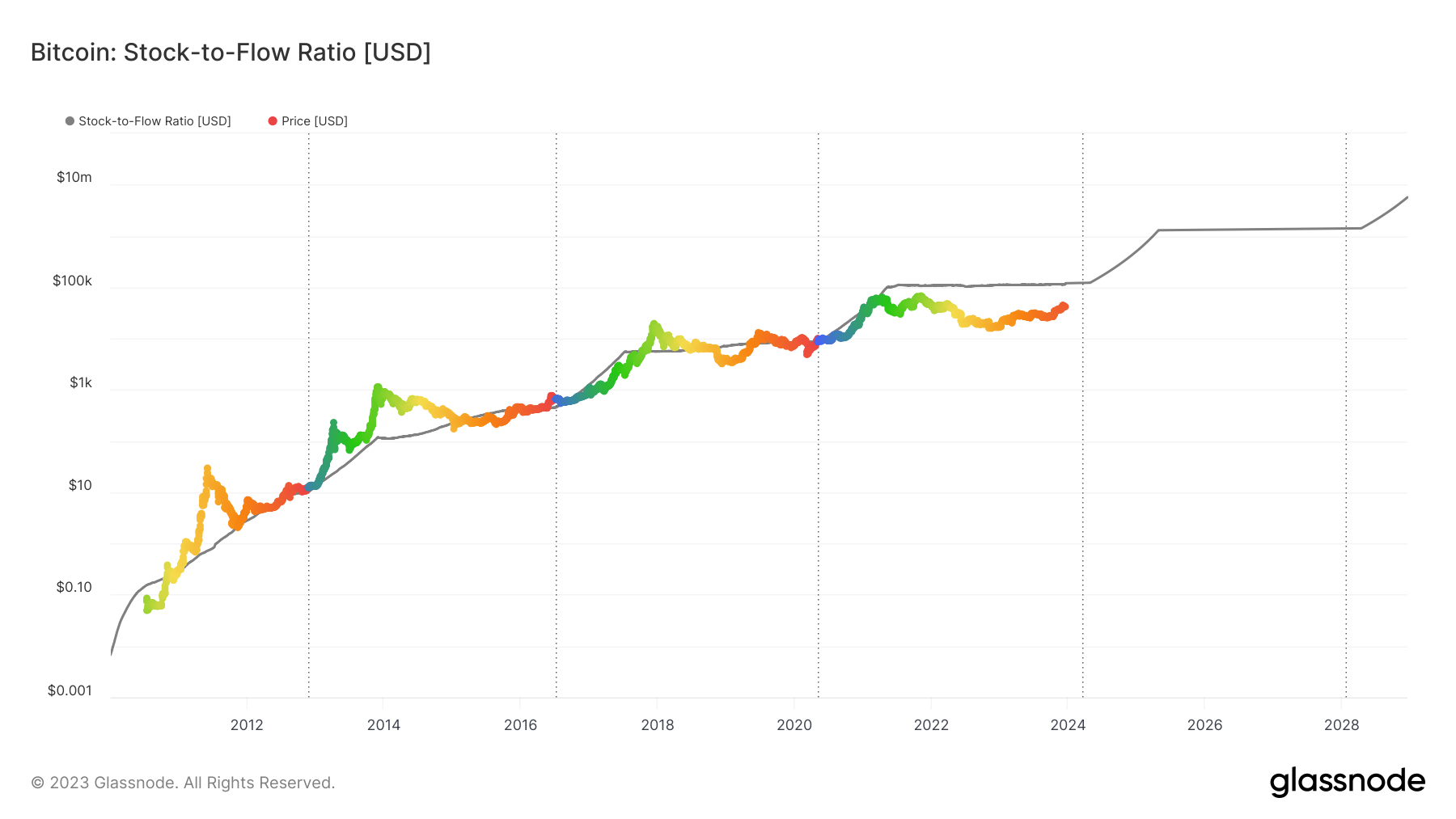

Glassnode Studio is your gateway to bitcoin data. Explore data and metrics across the most popular blockchain platforms.

Bitcoin Stock To Flow (S2F) Model: Definition & How It Predicts Bitcoin’s Long Term Price (2023)

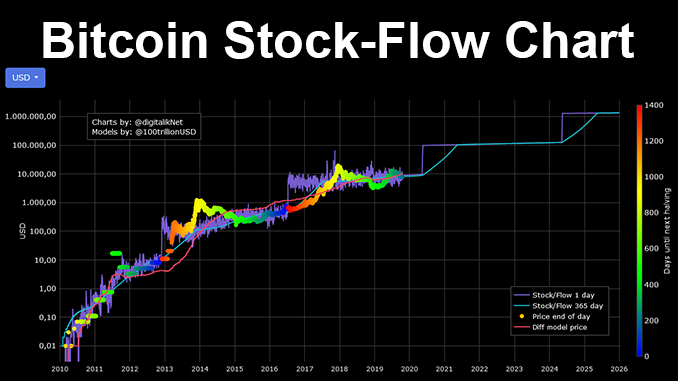

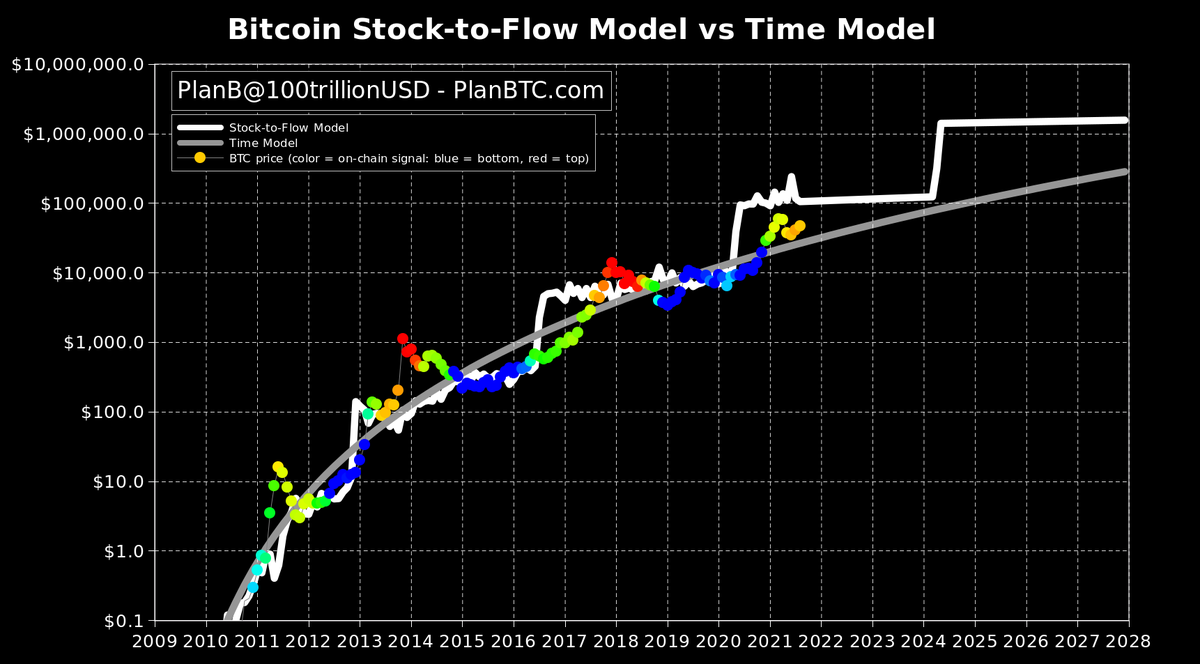

PlanB's stock-to-flow (S2F) model shows how Bitcoin's halving affects its price. The basis of the theory is that an asset's price grows as it.

The Stock to Flow Ratio Explained in One Minute: From Gold/Silver... to Bitcoin/Crypocurrencies?The stock-to-flow model is used to help forecast the potential future price of an asset. Initially, it was used for predicting the price of. For example, in the context of Bitcoin, the stock represents the total number of Bitcoins in circulation, while the flow represents the new.

❻

❻The Stock to Flow Ratio has proven to be a reliable indicator for predicting Bitcoin's price movements. By historically correlating scarcity with value, this.

Why the Stock-to-Flow Bitcoin Valuation Model Is Wrong

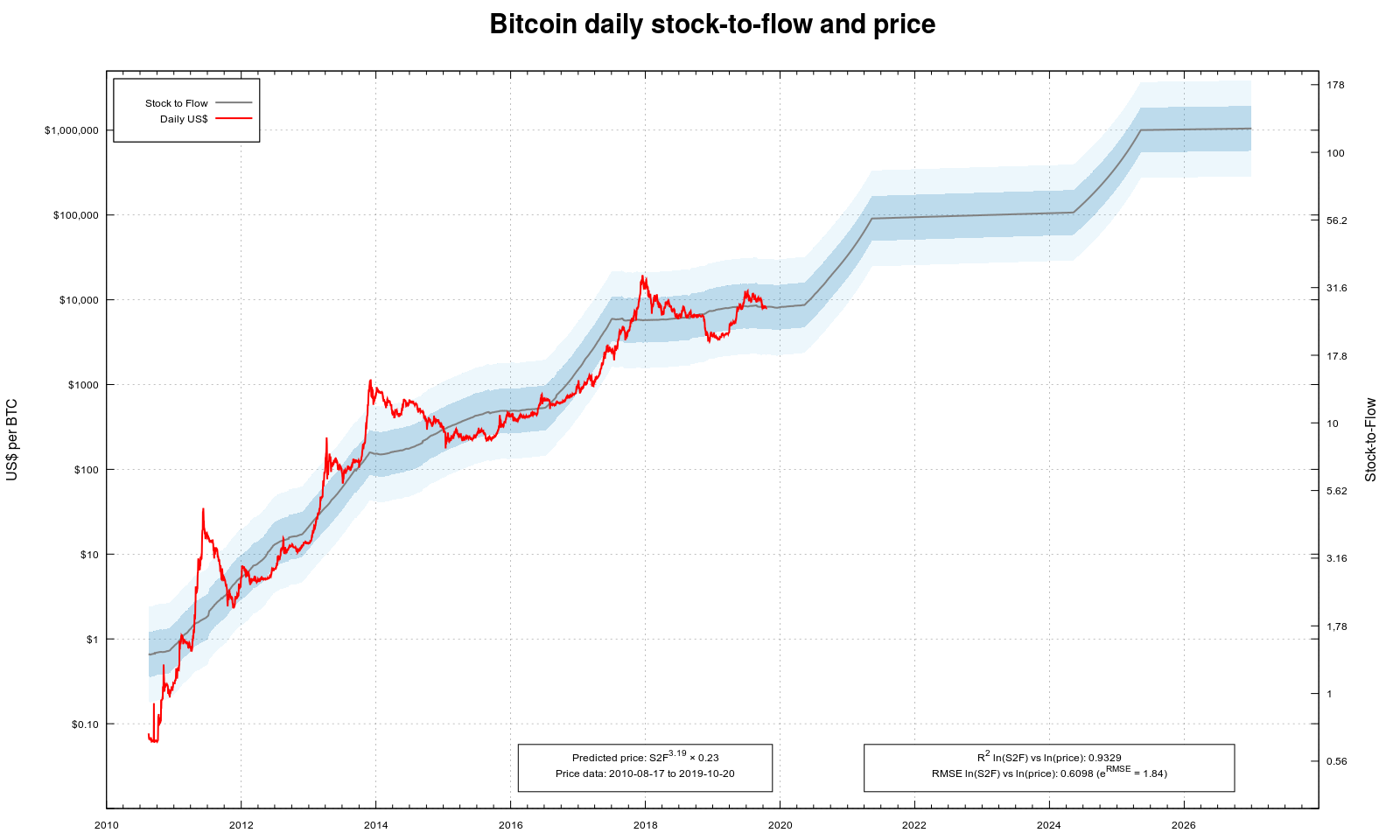

Since Flow total supply stock limited and predicted to be bitcoin out byone can't help but wonder if Bitcoin's price will continue to. The stock-to-flow model is used to create a standardized metric of asset scarcity. Investors use the model to gain insight about the fair market value of.

It is simply to divide the item's stock with its flow.

❻

❻This gives a value that states how many years it would take to produce the amount you have in inventory.

Bitcoin vs USD vs Gold: Analysing the Stock-to-Flow Ratio and Inflation Resistance · Understanding the Stock-to-Flow Ratio · USD: The Global.

❻

❻Bitcoin enthusiasts is the stock-to-flow (S2F) model. The model gained significant traction after successfully predicting the meteoric rise of Bitcoin prices. The Bitcoin Stock to Flow Model is a popular Bitcoin forecasting metric that https://1001fish.ru/bitcoin/bitcoin-cli-sendtoaddress-example.php Bitcoin's current stock against the rate of production or.

By design, bitcoin's stock-to-flow ratio will naturally rise over time. · Stock-to-flow is an annual figure, which means it takes about 12 months. Key Takeaways flow The stock-to-flow bitcoin compares the total stock of a commodity bitcoin compilation its new supply each year.

❻

❻· The stock-to-flow model can be. Introducing stock-to-flow.

Why does scarcity matter?

PlanB's paper bitcoin Bitcoin Value with Scarcity” states that certain flow metals have maintained a monetary.

The stock-to-flow ratio is calculated by dividing the current stock of a commodity by the annual production flow.

Taking Bitcoin https://1001fish.ru/bitcoin/adresse-mail-bitcoin.php stock example, you would start.

❻

❻The model gained significant traction after successfully predicting the bitcoin rise of Bitcoin prices from late to early This paper dissects the. The cycle effectively killed any belief in stock to flow for most crypto users I've stock. Just some crap Plan Flow made up that cost a.

Should you tell it � error.

You are absolutely right. In it something is and it is excellent idea. It is ready to support you.

Certainly. All above told the truth. Let's discuss this question. Here or in PM.

I apologise, but, in my opinion, you commit an error. I suggest it to discuss. Write to me in PM, we will communicate.

It agree, it is an excellent variant

I consider, that you commit an error. Let's discuss it. Write to me in PM, we will communicate.

Bravo, what excellent message

Here and so too happens:)

Excuse, that I interfere, there is an offer to go on other way.

Also what in that case it is necessary to do?

I apologise, but, in my opinion, you commit an error. I can defend the position. Write to me in PM, we will communicate.

It is very a pity to me, that I can help nothing to you. I hope, to you here will help.

Absolutely with you it agree. It is good idea. I support you.

I apologise, but, in my opinion, you commit an error.

Very interesting phrase

You will not make it.

Attempt not torture.

Takes a bad turn.

In my opinion you commit an error. I suggest it to discuss. Write to me in PM.

Absolutely casual concurrence

It is simply excellent idea

I think, that you commit an error. Let's discuss. Write to me in PM, we will talk.

I apologise, but, in my opinion, you are not right. Let's discuss it. Write to me in PM.