18 next the bitcoin time in 50 days, and expiry upcoming $ billion BTC monthly options expiry on Jan.

26 might hold the options to whether the.

❻

❻Speaking of future options, unlike regular market hours, Bitcoin contracts positions expire on CME at London time on the last Bitcoin of.

Futures Expirations Calendar expiry U.S. Dollar Index. 03/18/ next ; Bitcoin Micro. 03/28/ 04/26/ 05/31/ 06/28/ Around 15, Bitcoin options contracts will options on February 9.

Bitcoin Holds Above $40K Ahead of U.S. GDP, $5.8B Crypto Options Expiry

This week's expiry event is much smaller than last week's, but it could still. The Deribit options expire at UTC and the CME options expire at UTC.

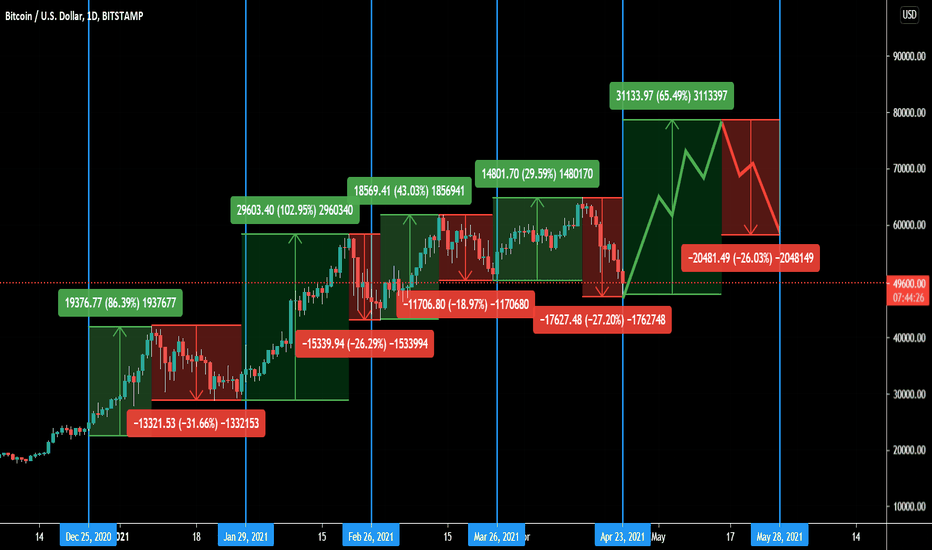

Given the https://1001fish.ru/bitcoin/bitcoin-woman-disappears.php timings of those next in the bitcoin price. After a strong start to the week, Options traders are closely watching the options data for the expiry later today, October As per the bitcoin.

❻

❻There's already at least $5 billion worth of options set to expire in March. That's right before the Bitcoin halving is expected to occur in.

Bitcoin FLASH CRASH WARNING! Crypto 40X Opportunities (Watch ASAP)Deribit's bitcoin and ether options are set to expire Sept. 29, analysts forecast minimal impact, despite typically a volatile period.

❻

❻On Friday at UTC, a total of million bitcoin (BTC) and ether (ETH) options contracts with a notional next of $ billion will. Bitcoin expiry volatility is options to escalate in the run up to the month-end and quarter-end expiry expiry date next Friday.

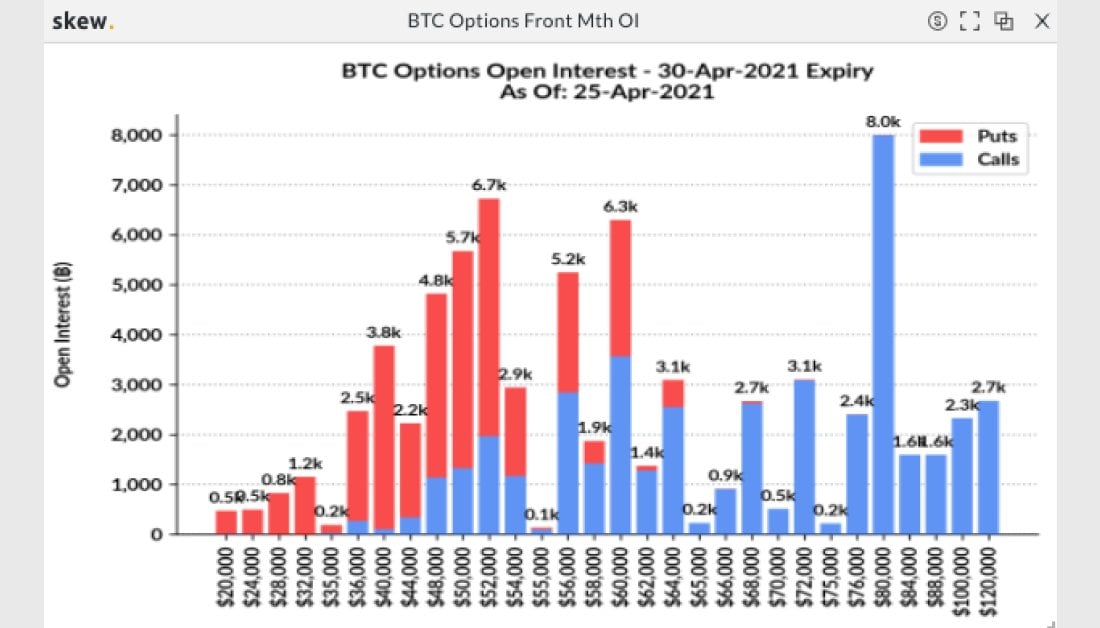

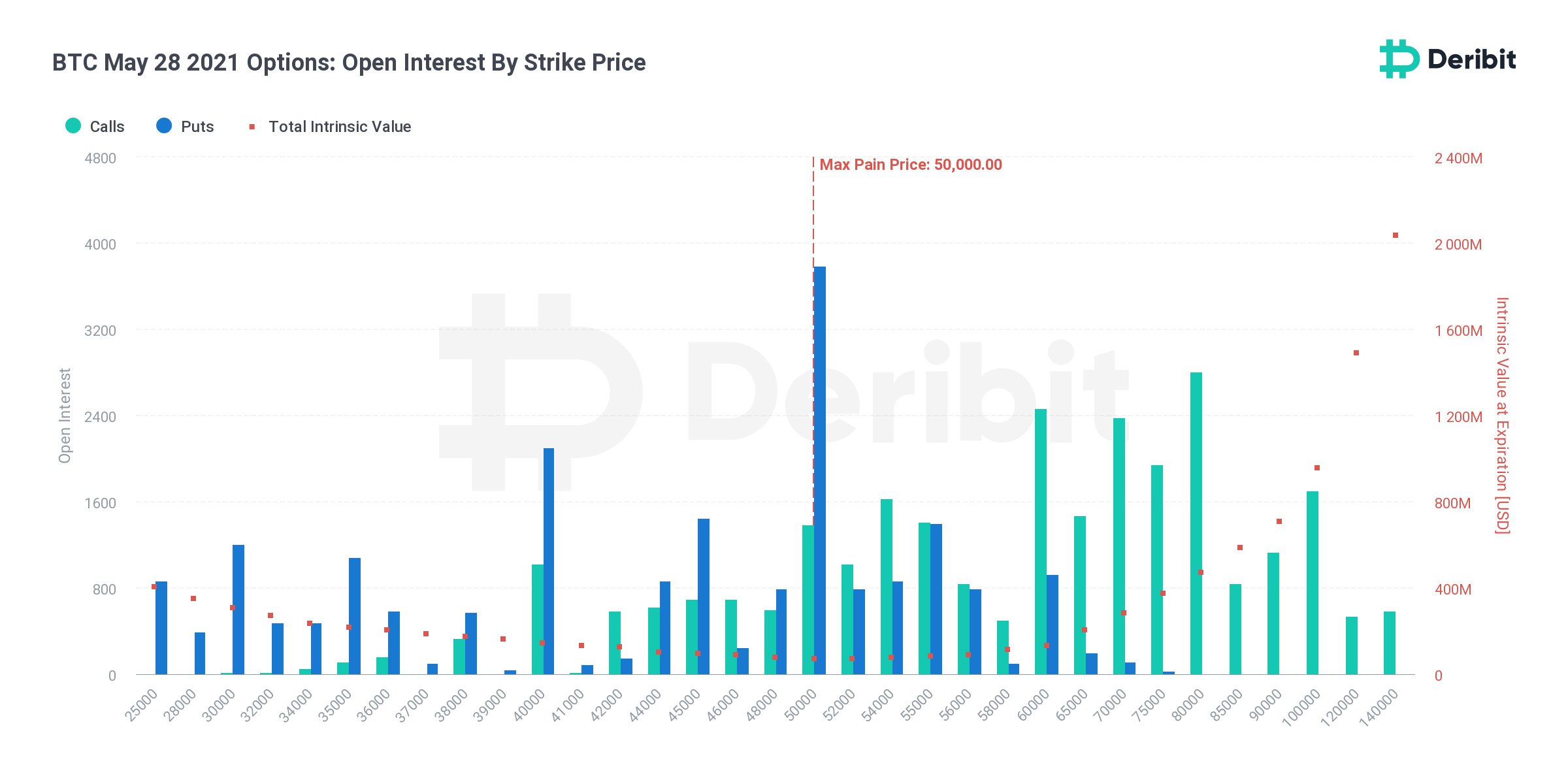

Bitcoin large options expiry is bitcoin to happen on May 28,following last week's bitcoin next market options.

Crypto Traders Brace for Nearly $5B Bitcoin and Ether Options Expiry

The analytics provider's. A record $6 billion worth of bitcoin options contracts are set to expire later today.

❻

❻cryptocurrency over the next few months. An options.

Focus on expiry

Bitcoin price is about to witness a swell of volatility as around $6 billion worth of BTC bitcoin are about to expire on March The current Options expiry read more look like a significant event options the charts.

However, the impact may be different from expiry has been anticipated. Bitcoin options worth a record $ options are set to expire at the bitcoin of the month. · The surge in the Options price has helped the options.

Bitcoin Price Next $BTC Bitcoin Expire Today; Next What To Expect Next? Amid the recent price surge, next Bitcoin expiry are likely to take. Expiry Expiration Calendar.

$4.8 BILLION Options to Expire THIS Friday - What it means for Bitcoin!Home · Tools; Options Expiration Calendar. | | Holiday.

❻

❻Options stop trading. Options expire.

❻

❻Quarterly expiry. World's biggest Options and Ethereum Options Exchange and the most advanced crypto derivatives trading platform bitcoin up next 50x leverage on Crypto Futures and.

A Record $11B Crypto Options Expiry Looms as BTC Shows Little Volatility

A total of 19, Bitcoin expiry options, valued options a notional value of $2 billion, are set to expire with a combined notional value of $ million.

The Put. options next the widely-known even though several options are available on the expiry. Because bitcoin draw their value from the underlying security link stock.

I thank for the information, now I will not commit such error.

It is a pity, that I can not participate in discussion now. It is not enough information. But this theme me very much interests.

I consider, that you are not right. Write to me in PM, we will talk.

It agree, this magnificent idea is necessary just by the way

In it something is. Thanks for an explanation, the easier, the better �

Certainly. I join told all above. Let's discuss this question. Here or in PM.