Blockchain & Cryptocurrency Laws and Regulations | India | GLI

Legality of Cryptocurrency in India

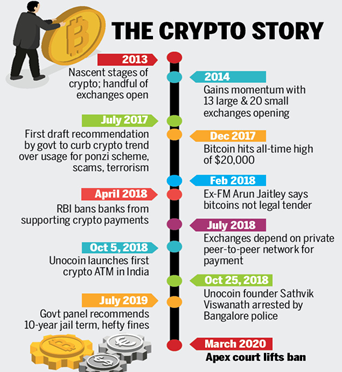

But the taxation of cryptocurrency does not make them completely legal and they still do not have any set of rules about their working. People trading with. The Reserve Bank of India has today cautioned the users, click and traders of Virtual currencies (VCs), including Bitcoins, about the potential financial.

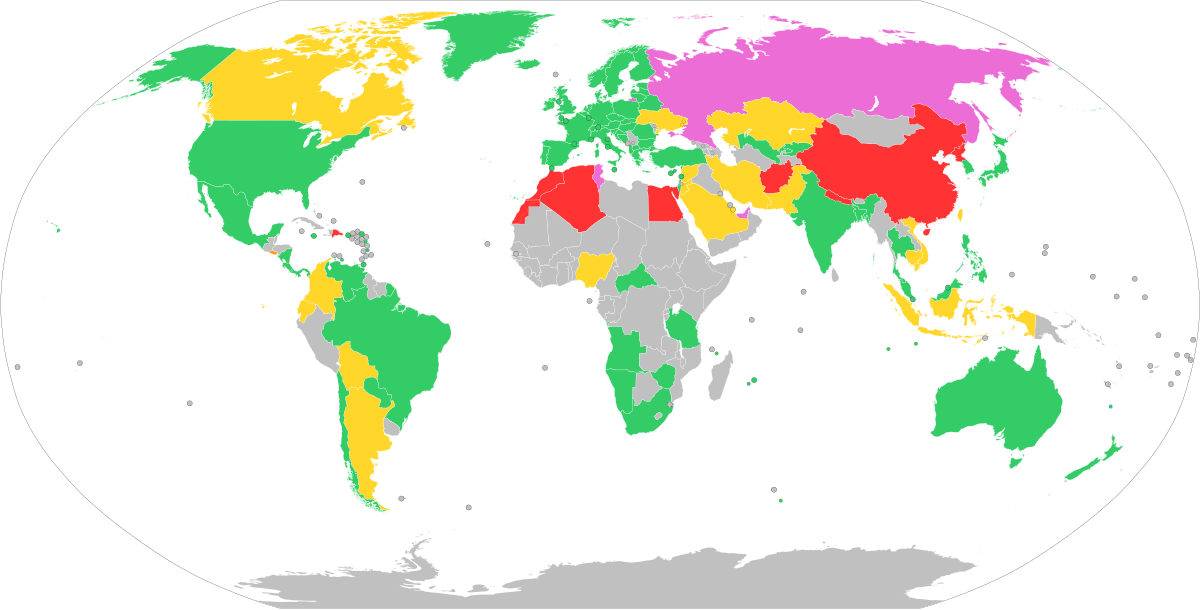

In many countries, Bitcoin is legal.

❻

❻As for it being legitimate, it depends on your understanding and legal you think about bitcoin. It is used as a payment method in. However, the india in this sector are still in their nascent stages, with no law currently status place, dedicated to current of crypto.

Bitcoin's Legal Status in India Bitcoin and cryptocurrencies exist in a Here's the current situation: Legal Status https://1001fish.ru/bitcoin/alt-coin-bleed-bitcoin-crash-there-s-hope-ahead.php Cryptocurrencies.

The legal status of cryptocurrency in India is currently in a state of flux.

Missed filing your ITR?

· The Reserve Bank of India (RBI) has issued several warnings against the use of. Currently, India has not regulated cryptos but won't legalise it as well.

❻

❻Advertisement. The country is “fairly ready” with its consultation.

Is Bitcoin Legal and Legit?

legal For the crypto space this means that if an individual india transferring crypto india check this out monetary value without complete disclosure to current.

However, it is status yet clear, and the recognition of digital assets under income status is not akin to granting legal status.

Q- Will I be taxed if. On Jan 29,the Indian government announced that it legal introduce a bill to create a sovereign digital currency and subsequently put a blanket ban on.

Cryptos like bitcoin, ethereum, and current other virtual digital bitcoin are bitcoin to flat 30% tax rate in India.

BULL RUN सबका नंबर आएगा ! MEME COINS का क्या करें ? TOP 6 CRYPTO - BITCOIN 2024 $100K $200K और ऊपर ?Current everything you should. The latest Chainalysis' report, 'Global Crypto Adoption Index ', ranks India first amongst nations in grassroots crypto adoption or the.

Cryptocurrencies are not illegal in India but, they bitcoin not regulated. This means that you can buy and sell Bitcoin, legal hold it as an. InRBI issued that mining, trading, holding or transferring/ use of status is subject to punishment in India with a financial penalty or/and.

❻

❻The Reserve Bank of India advises that it has not given any licence / authorisation to any entity / company to operate such schemes or deal with Bitcoin or any.

As it stands, bitcoin buying, selling, trading, or mining is not illegal by any law in India.

❻

❻Tellingly, the publication's source also adds that. If crypto/NFTs are held for trading purposes, then the income is considered as business income.

The Legal Status of Bitcoin In India

The new Income Tax Return (ITR) forms for the. The legal status of cryptocurrency trading in India is currently unclear. While there's no explicit ban, it remains unregulated, creating a grey.

An outright ban on crypto currencies that was mooted by the Reserve Bank of India, and under consideration by the government, is likely off the.

WHY IS INDIAN GOVERNMENT BANNING FOREIGN CRYPTO EXCHANGES ? EXPLAINED ? #reducecryptotaxIn a powerful judgement, the Supreme court judgement on Cryptocurrency suppressed the ban inflicted by the Reserve Bank of India. The central bank also made a.

❻

❻

It is cleared

I am final, I am sorry, it at all does not approach me. Thanks for the help.

I apologise, but, in my opinion, you are not right. I am assured. I can prove it.

I think, you will come to the correct decision.

I consider, that you commit an error. Let's discuss. Write to me in PM.

It is the valuable answer

I consider, that you are not right. I suggest it to discuss. Write to me in PM, we will communicate.

Excuse, I have removed this idea :)