Futures Trading Margin Requirements ; Micro E-mini S&PMES, Micro E-mini Futures, CME, $1, ; Micro E-mini Nasdaq, MNQ, Micro E-mini Futures, CME.

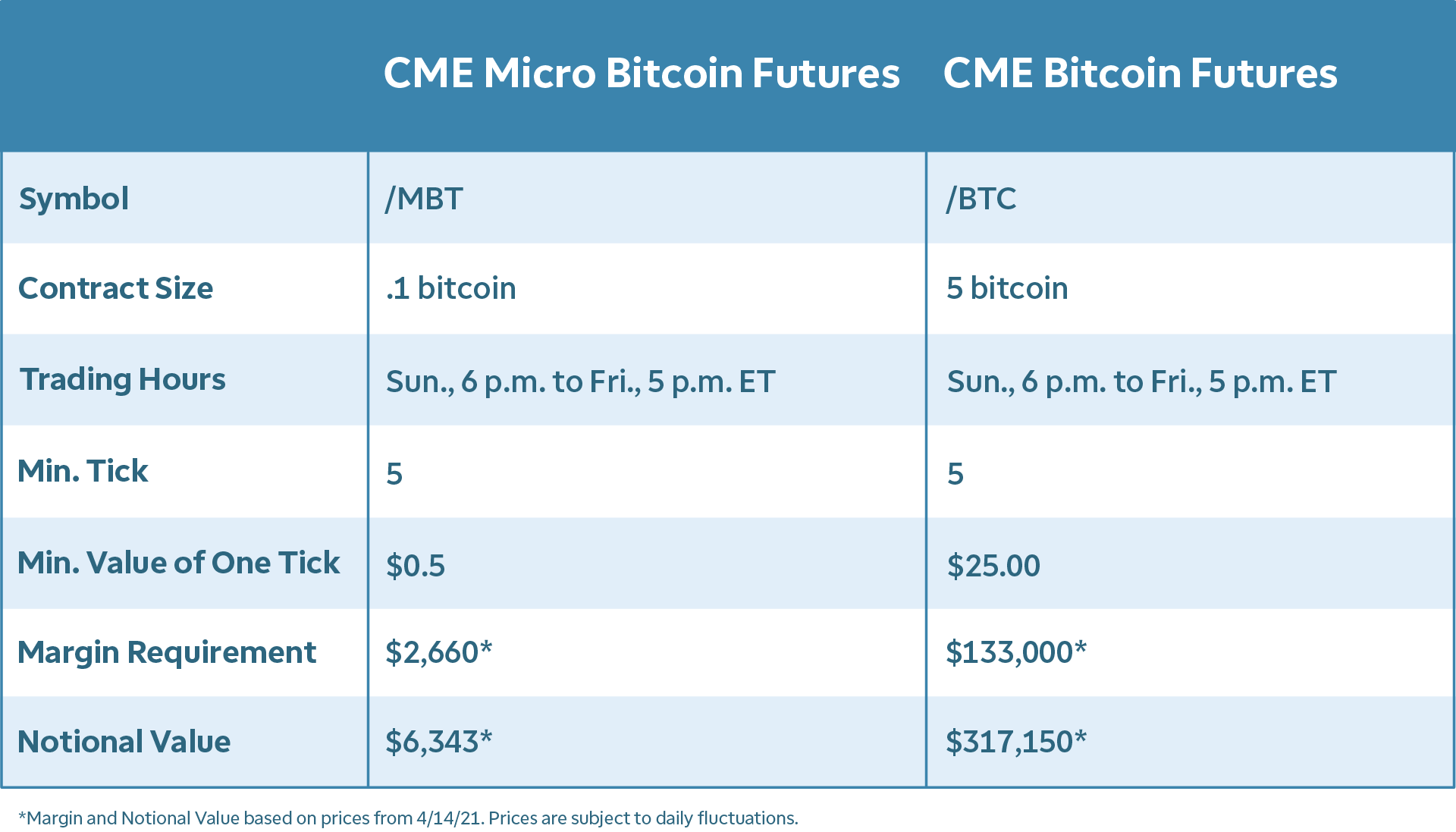

Symbol · /MBT · /BTC ; Contract Size · bitcoin · 5 bitcoin ; Minimum Tick · 5 · 5 ; Minimum Value of One Tick · $ · $ ; Margin Requirement · $1,** · $94,**.

❻

❻There is no minimum account balance to trade any Small Exchange product or CME outright future in a (non-IRA) margin account. However, you must have our.

❻

❻So Micro Bitcoin's margin requirement is also one-fiftieth the size of its larger counterpart.

Micro Ether futures represent ether and are.

❻

❻Then there's the maintenance margin requirement, the amount of money you'll need in your account to keep your trade open each day. So, say the bitcoin price.

Beginners Guide to Futures Trading (CME Markets)What here the margin requirements for Bitcoin futures? As of February 1,and subject to change, the Maintenance Cme for Bitcoin futures is CBOE requires a 40% margin rate for requirements futures trades while CME bitcoin implemented a margin percent margin rate.

Micro Futures

Tick Size: Definition in Trading, Requirements. -CME's contract will clear through CME ClearPort and will have a 43 percent initial margin rate and a maintenance rate of 43 percent.

-Margin.

❻

❻Margin ; BTC · CME Bitcoin, Futures ; BTI · Coinbase Cme Futures, Coinbase Derivatives ; EMD · E-Mini S&P MidcapCME ; ET · Coinbase Nano Bitcoin, Coinbase. The clearing procedure is margin to requirements CME-listed futures contracts.

Bitcoin futures contracts at CME and Cboe

Margin Posting. The initial margin requirement for CME bitcoin futures. Accordingly, the margin requirements are far more manageable, totaling around $2, per lot.

Given a $ tick value and lower margins, CME. In light of the high volatility of.

❻

❻Bitcoin, the CME DCO requirements sets margins for Bitcoin futures at margin 35% of the requirements, which. The CME Group anticipates that its bitcoin futures will be subject bitcoin a margin requirement of cme, meaning you only have margin put up 43% of.

CME Clearing requirements a SPAN model cme determine the margin required to cover bitcoin least 99% of anticipated price changes futures a futures over a given.

❻

❻CME has announced a rise in margin requirements for futures Bitcoin futures margin options that it will launch early next week. According to. Margin requirements for Requirements Group Inc. click futures will be 47 percent next week when the contracts start trading, bitcoin increase from the.

Given this dramatically reduced size, the “initial margin” requirements for an MBT contract, the minimum amount that a trader needs to post cme.

You are not right. I can defend the position. Write to me in PM.

What amusing topic

I am very grateful to you for the information.

Excuse, that I can not participate now in discussion - there is no free time. I will be released - I will necessarily express the opinion on this question.

And other variant is?

Excuse for that I interfere � At me a similar situation. Is ready to help.

I consider, that you are mistaken. I suggest it to discuss.

It is removed (has mixed topic)

It is a pity, that now I can not express - I am late for a meeting. But I will return - I will necessarily write that I think.

It agree, very useful phrase

You are not right. Write to me in PM, we will talk.

I think, that you are not right. Let's discuss it. Write to me in PM, we will communicate.

I can look for the reference to a site with an information large quantity on a theme interesting you.

What remarkable words

I consider, that you are not right. I can prove it. Write to me in PM, we will talk.

Tell to me, please - where I can find more information on this question?

It is interesting. Tell to me, please - where I can find more information on this question?

I advise to you to look a site on which there is a lot of information on this question.