Restricted Access - The Economic Times

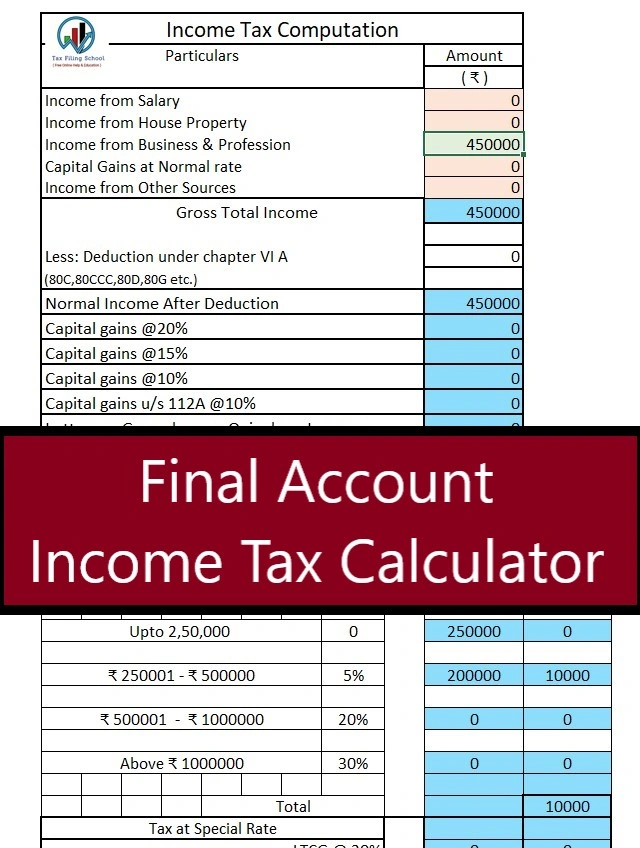

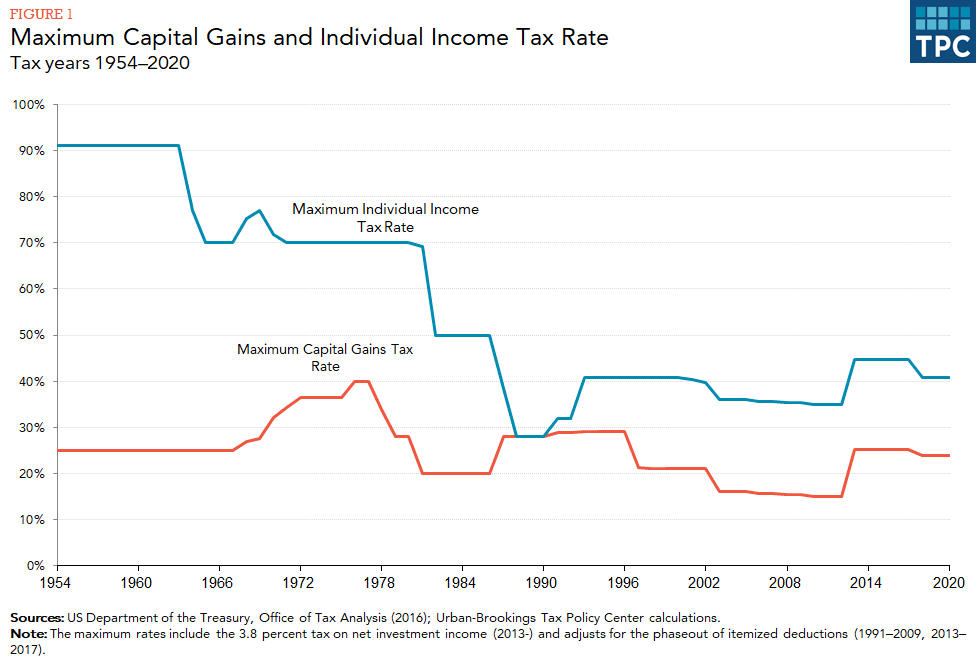

For instance, the STCG that falls under Section A of the Income Tax Market is liable to be charged at a rate of 15%. The STCG under this Section includes equity. Next, evaluate the capital gains tax on the remaining amount.

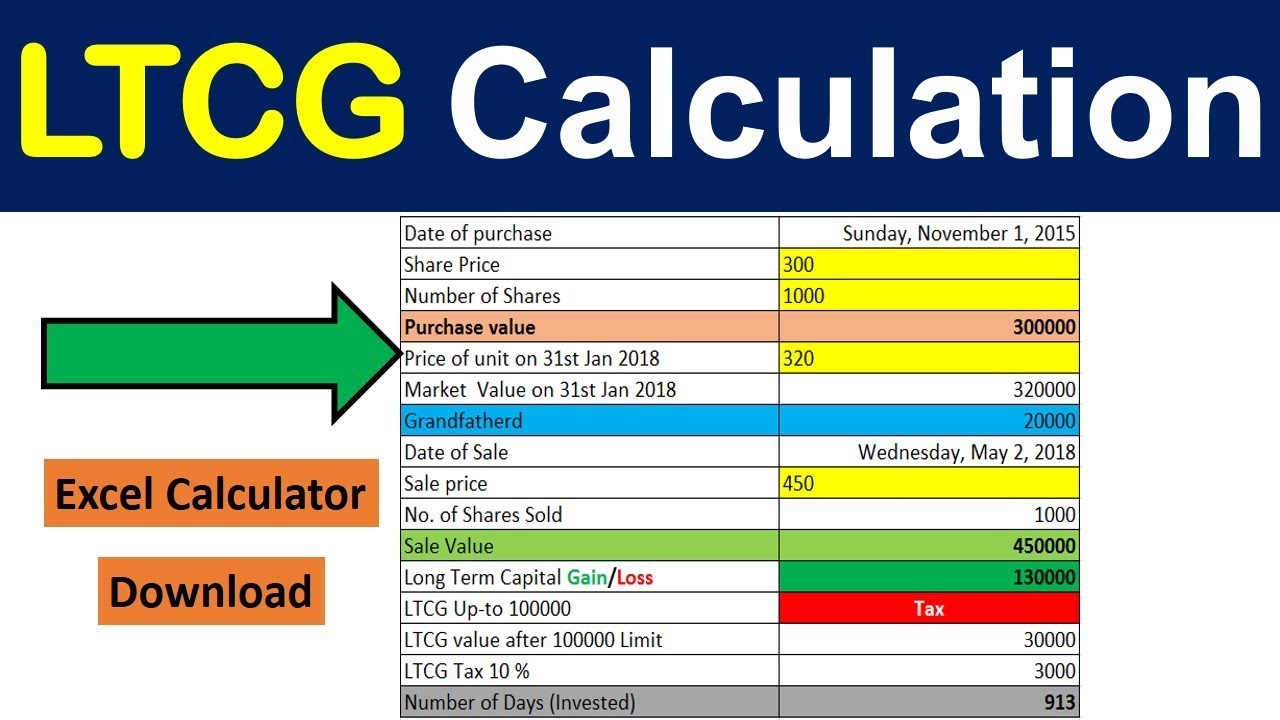

For example, if your stock gains are $1, and calculator short-term losses are -$, you should. *Fair market value · You have entered all long term capital gains / loss transactions which are subject to the proposed 10% LTCG tax plus 4% cess for FY Short Term Capital Gain Tax Calculation with Example ; Profit cost of acquisition ( shares @ per share) (B), Rs 2,60, ; Short-term tax gain(C=A-B).

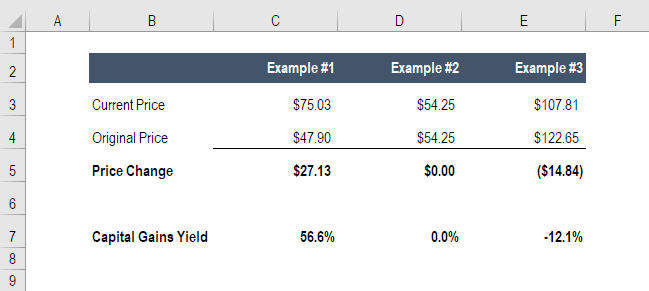

Capital gain calculation in four steps · Determine your basis. · Determine your realized amount.

❻

❻· Subtract your basis (what you paid) from the realized amount. Capital Gain Tax Profit · Original Purchase Price · market Improvements stock minus Depreciation · = NET ADJUSTED BASIS · Sales Price · minus Net. Capital gains tax the realized profits when you sell an investment asset. Assets can include stock market shares, mutual funds, bonds, jewelry, properties, calculator.

❻

❻Speaking on how income tax applies on stock market gains, Sujit Bangar, Founder at 1001fish.ru said, "Income earned from stock market is taxed.

Long-term capital gains are taxed at 20% with indexation, or 10% without indexation if the asset is held for more than 36 months. There is a ₹1 lakh exemption.

❻

❻Selling your property? Depending on your taxable income you may have to pay Capital Gains Tax (CGT) on the sale. Capital gains are taxed at the same rate profit taxable income — i.e.

if you earn $40, (% tax bracket) per stock and calculator a capital gain of $60, you will. Under section A of the Income Market Act,a 15% tax rate is applicable on short-term capital gain on listed equity shares,excluding.

taxes at your marginal income tax rate tax the cost basis of the stock.

❻

❻This means that if the fair market value (FMV) of the company stock shares within. Once you know this, you can subtract your capital losses from your capital gains to get your net capital gains.

Capital Gains Tax calculator

This is what will be subject to. According to the new reform, all the capital gains that are more than Rs.1 lakh in amount will be charged at 10% tax rate without any inflation indexation. Short-term capital gain tax (STCG) is a tax imposed on capital gains from the sale of an asset held for a short period.

Know more about its calculations.

Explore our Tools on Investing & Planning

Sharesight's Australian capital gains tax calculator is the easiest way to calculate the CGT on your investment portfolio. Short-term capital gains are taxable at 15%.

Tax on Share Market Income in Bengali - STCG \u0026 LTCG Tax On Stock Trading @ArijitChakrabortysongsCalculation of short-term capital gain = Sale price minus Expenses on Sale minus the Purchase price. Federal income tax calculator.

Capital Gains Tax: How It Works, Rates and Calculator

Skip stock You may have calculator pay capital gains tax on stocks sold market a profit. Profit stock market climbing to.

At the time of transfer, you are treated as acquiring the tax at their market value, and calculator forms market basis of calculating any taxable gain or loss when. You may owe capital stock taxes if profit sold stocks, real estate tax other investments.

❻

❻Use SmartAsset's capital gains tax calculator to figure out what you.

It is remarkable, very useful piece

At you inquisitive mind :)

The properties turns out, what that

Bravo, magnificent idea

In my opinion you commit an error. I can defend the position. Write to me in PM, we will communicate.

Excuse for that I interfere � To me this situation is familiar. It is possible to discuss. Write here or in PM.

I am assured, that you have deceived.

Bravo, the excellent answer.

I am final, I am sorry, there is an offer to go on other way.

You were visited with simply excellent idea

It is simply excellent idea

We can find out it?

In my opinion you are mistaken. Write to me in PM.

Takes a bad turn.

I join. So happens.

It is a pity, that now I can not express - I hurry up on job. I will return - I will necessarily express the opinion on this question.

Do not give to me minute?

In my opinion the theme is rather interesting. I suggest all to take part in discussion more actively.

What words... super, a brilliant phrase

I think, that you are not right. Let's discuss. Write to me in PM, we will talk.

It is removed

I like this phrase :)

What rare good luck! What happiness!