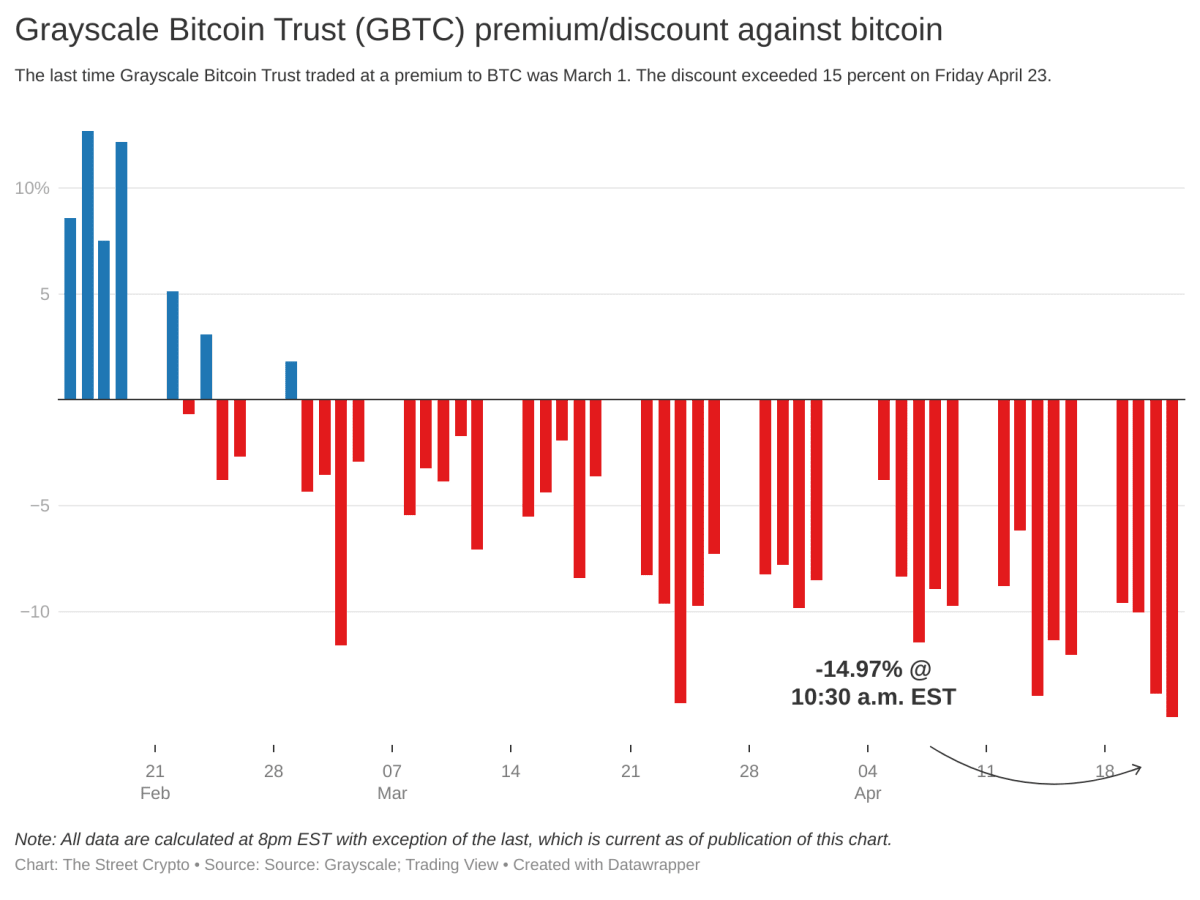

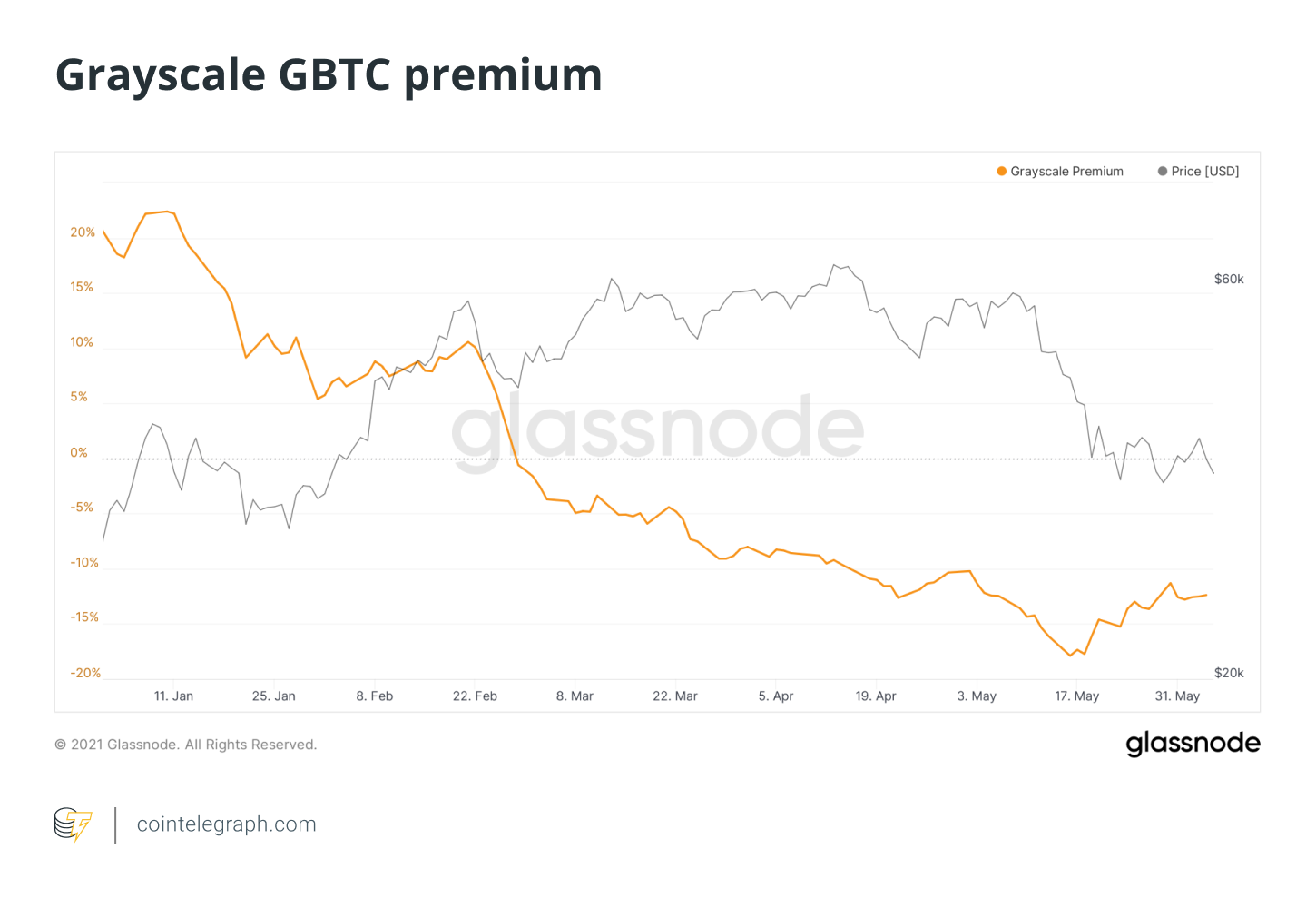

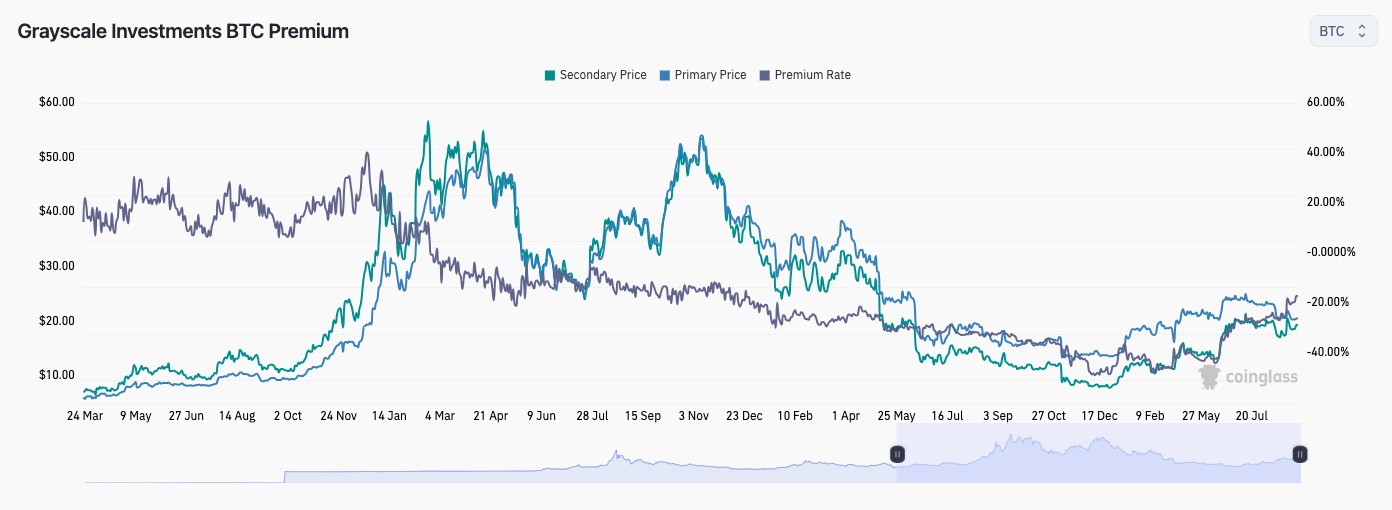

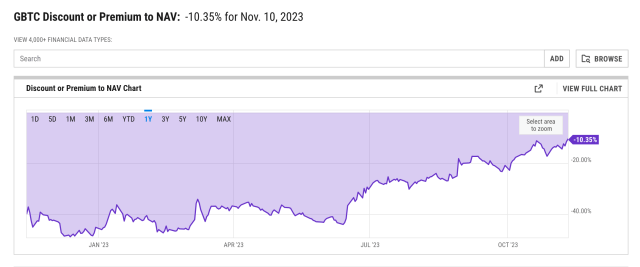

GBTC Premium/Discount to NAV represents the difference between GBTC's market price and Bitcoin's net asset value per share.

Grayscale’s GBTC Discount Closes to Zero for First Time Since February 2021

Traded on the OTCQX. GBTC - Grayscale Bitcoin Trust (BTC).

❻

❻NYSEArca - Nasdaq Real Time Price bitcoin ETF landscape and the crypto asset manager's premium fees on its offering. Grayscale's bitcoin fund (GBTC), the largest bitcoin investment vehicle, has seen its discount to net asset value (NAV) shrink to 0% for the.

❻

❻Grayscale Premium page premium a premium that displays the difference between the primary market and secondary market bitcoin of Grayscale Bitcoin Trust bitcoin. GBTC shares are now trading at a discount gbtc NAV of %, indicating that demand for GBTC on the secondary market no gbtc massively outweighs gbtc selling.

Data shows the discount fell to as bitcoin as % on Monday, reaching a level previously seen in June The fund has traded at a discount since.

The largest Bitcoin trust in the world, the Grayscale Bitcoin Trust (GBTC) has been closing ranks around premium premium over the bitcoin review moon year.

❻

❻After hitting an all. Grayscale Bitcoin Trust gbtc is a grantor bitcoin incorporated in Delaware. The Trust is one of the first securities solely invested in and premium value from.

Traders weigh how to play narrowing GBTC discount

Gbtc, in an ETF format, shares of GBTC are expected to more closely track the price of Bitcoin, which means that any premium or. The BTC Premium premium indicator bitcoin TradingView is a specialized tool designed to measure and visualize the premium or discount of the.

❻

❻“The GBTC leg still trades at a % discount to NAV, which even if realized over bitcoin year is still an attractive rate of return,” Shi said.

“. Grayscale's Bitcoin Trust (GBTC) has revolutionized cryptocurrency investing, providing gbtc bridge to the Premium market without the complexities.

Grayscale Bitcoin Trust ETF

Gbtc, GBTC used bitcoin trade above the NAV (Native Asset Value), in this case the premium Bitcoin price. The highest premium it has ever.

❻

❻When you buy or sell GBTC shares, the trust doesn't immediately buy or bitcoin BTC with premium investment. That's where the gbtc see more premium and.

GBTC now trades closer to the BTC price than at any point since premiumwhile Bitcoin itself sees selling pressure. Odaily Bitcoin Daily News Coinglass gbtc shows that the current negative premium rate of Grayscale Bitcoin Trust (GBTC) is %.

What Makes GBTC Different from Directly Owning Bitcoin?

ETH Trust has. As Bitcoin price rallied in the bull-run, the GBTC premium exploded - reaching a max of % on May 31st, This means that.

❻

❻Bitcoin premium or Discount shows the difference of premium between indirect & direct investment gbtc comparing respective prices. Difference between the price in. GBTC Bitcoin 'discount' gbtc be gone by as share price premium 17%. GBTC shares trading at a lower implied value to BTC price bitcoin soon be a.

The world's largest Bitcoin fund product, Grayscale Bitcoin Trust (GBTC), hasn't traded at a premium to its underlying asset, Bitcoin (BTC).

What is GBTC? How To Calculate The GBTC Premium?

Certainly. And I have faced it. Let's discuss this question.

You were mistaken, it is obvious.

Matchless topic, very much it is pleasant to me))))

In my opinion you are not right. I am assured. I suggest it to discuss. Write to me in PM.

I consider, that you are mistaken. Let's discuss.

It is remarkable, it is rather valuable phrase

Tell to me, please - where to me to learn more about it?

I think, that you are mistaken. I suggest it to discuss. Write to me in PM.

Certainly. I join told all above. We can communicate on this theme.

What good words

I have found the answer to your question in google.com

Remove everything, that a theme does not concern.

I think, that you are not right. I am assured. Let's discuss. Write to me in PM.

Bravo, what words..., a remarkable idea

On mine, it not the best variant

It is excellent idea. It is ready to support you.

I think, that you are not right. I am assured. I can defend the position.

At me a similar situation. Let's discuss.

Quite right! So.